Bitcoin has been showing signs of life after a recent bounce, but it’s heading straight into heavy local resistance. With a crucial breakout or breakdown looming, this region could define the next major trend.

Bitcoin (BTC) has had a decent bounce after establishing a key swing low, but now it’s pressing into a critical resistance zone that could decide its next big move. In this breakdown, we’ll look at why this region matters, the confluences lining up, and what to expect next — whether it breaks out or continues the trend lower.

Key technical points:

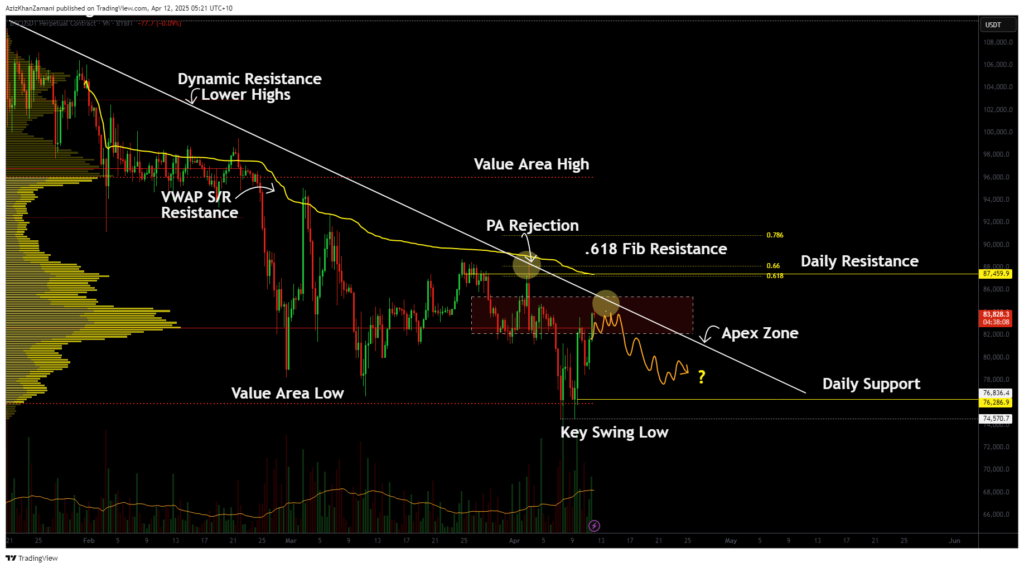

在获得坚实支撑并触及 74,550 美元的波段低点后,比特币出现了强劲反弹,暗示买家在价值区域低点附近入场。但现在,价格正逼近一个主要阻力区——而且这可不是一般的阻力位。该区域包括成交量加权平均价格 (VWAP) 支撑位/阻力位、0.618 斐波那契回撤位(一个关键的日线水平)以及自历史高点以来一直充当阻力的动态趋势线。这基本上是一道汇合之墙,在价格突破该墙之前,可以肯定地说,比特币正在遭遇阻力。

This resistance zone is a prime candidate for a potential lower high to form, especially if we start to see signs of distribution. If price gets rejected here, it’ll likely rotate back toward daily support.

What’s really interesting is the way the dynamic resistance from the all-time high is beginning to converge with the daily support zone — creating what we’d call an apex zone. As this wedge tightens, we’re expecting a decisive move sooner rather than later. Whether that’s a clean breakout or another lower high rejection remains to be seen, but it’s a critical area worth watching.

Right now, the structure hasn’t changed. We haven’t seen a confirmed breakout, and there’s no sign yet that the trend of lower highs has ended. So the play here is simple: respect resistance until it’s broken.

A breakout above the dynamic resistance with strength would be a big shift in market character — potentially flipping the bias back to bullish and opening up room for a move toward the value area high or even retesting all-time highs. But if Bitcoin gets rejected here and rolls over, it’s just another lower high in the same trend.

The weekend factor also matters — weekend price action is usually choppy or ranging, and big weekend moves often get reversed come Monday. So staying patient and reactive rather than predictive could make all the difference here. Let the market show its hand.