Stablecoins: The gateway to mainstream crypto in 2025 | Opinion

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Cryptocurrency is quite a novel invention: Bitcoin (BTC) was born just 17 years ago, and it’s still in its teenage years. No wonder, this decentralized finance industry is constantly changing and developing. In this ever-evolving crypto landscape, stablecoins have emerged as heroes, facilitating the transition from traditional finance to decentralized finance.Â

Often overshadowed by the volatility of cryptocurrencies, including the major ones like Bitcoin and Ethereum (ETH), stablecoins offer a semblance of stability in a tumultuous market. Their pegged value to fiat currencies, primarily the world reserve currency, U.S. dollar—such as Tether (USDT) and USD Coin (USDC)—provides a reliable medium of exchange, making them increasingly attractive to both individual users and institutional investors beyond the crypto space.

You might also like:Beyond the peg: Synthetic dollars are reshaping stablecoins | Opinion

The surge in stablecoin adoption

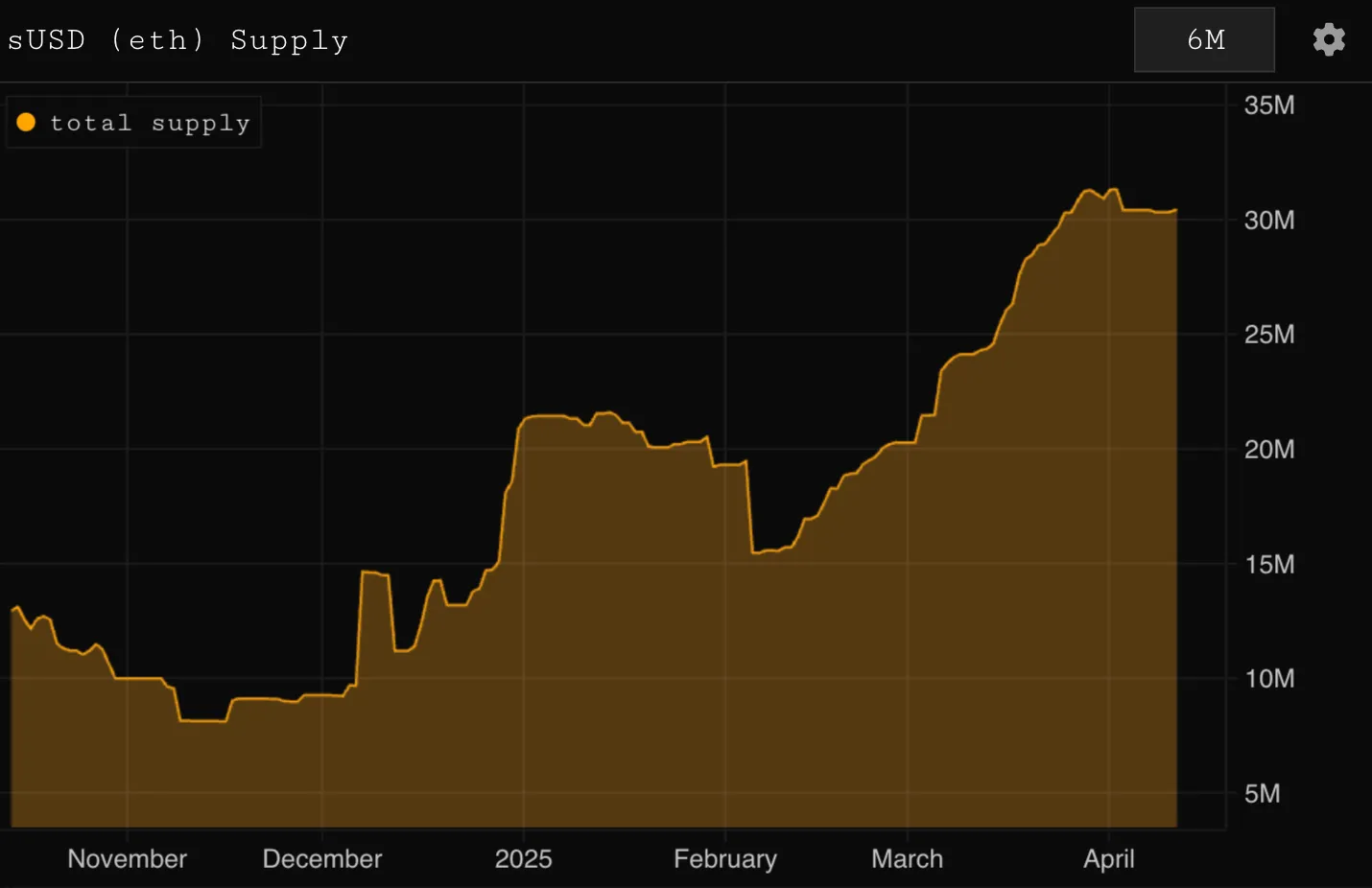

Recent data underscores the burgeoning adoption of stablecoins. According to a joint report by on-chain analysis platforms Artemis and Dune, active stablecoin wallets have surged by 53% over the past year, escalating from 19.6 million in February 2024 to over 30 million in February 2025. This significant uptick reflects a growing trust in stablecoins as a viable financial instrument, bridging the gap between conventional finance and the crypto realm.

This growth isn’t merely a numerical increase; it signifies a paradigm shift in how users perceive and utilize digital currencies. The stability offered by digital assets redeemable 1:1 with fiat currencies makes them ideal for everyday transactions, savings, and as a hedge against the volatility inherent in other cryptocurrencies.

Unsurprisingly, the United States issued timely guidelines for regulating stablecoins. The U.S. Securities and Exchange Commission issued a notice, paving the way for a more regulated and stable digital asset landscape. As Selva Ozelli, an international tax attorney and a regular columnist at Crypto.news, explained:Â

“The SEC notice gives examples of readily liquid assets that should back a Covered Stablecoin which include USD cash equivalents, demand deposits with banks or other financial institutions, US Treasury securities, and/or money market funds registered under Section 8(a) of the Investment Company Act of 1940, and do not include precious metals or other crypto assets.â€

As per data on stablecoins, Albridge internal analytics indicate that USDT retains its transactional lead in transactions and demonstrates 7% to 20% growth in month-over-month transaction volume between March 2024 and March 2025. USDC, on the other hand, remains second in the number of transactions and less popular than USDT in terms of transactional amounts, averaging at 25%. The total volume of USDT and USDC transactions varies from $85M to $198M between February 2024 and February 2025. Evidently, stablecoins are getting their momentum.Â

Transaction volumes rivaling traditional payment networks

The practical utility of stablecoins is further evidenced by their staggering transaction volumes. Earlier this year, an asset management firm, ARK Invest, issued a report that highlighted the growth of stablecoin adoption, whose transaction value in 2024 reached $15.6 trillion, overtaking traditional payment firms Mastercard and Visa by more than 100%. This monumental volume underscores the growing reliance on stablecoins for a myriad of financial activities, from remittances to institutional settlements.

Another report, issued by Citigroup, a multinational investment bank and financial services company, forecasts a potential fivefold increase in the stablecoin market over the next five years, possibly reaching nearly $4 trillion. Moreover, if the U.S. implements a regulatory framework, stablecoin issuers could emerge as major holders of U.S. Treasuries by 2030, potentially generating over $1 trillion in additional demand for Treasuries due to the expansion of stablecoins.

Bridging fragmented blockchains

Users and developers today encounter numerous obstacles when working across multiple blockchains. Delivering a seamless web3 user experience is already a complex task, if we want mass adoption in the crypto industry. Moving tokens between layers tends to be cumbersome, slow, and fraught with risk. Developers face the added difficulty of dealing with fragmented ecosystems, each featuring distinct tools and protocols. Meanwhile, users often face repeated challenges due to inconsistent wallet compatibility and varying user interfaces across chains.

As the crypto ecosystem becomes increasingly fragmented with multiple blockchains, the need for seamless interoperability has never been more critical. We, at Allbridge Core, address this challenge by offering a native stablecoin bridging experience, enabling seamless cross-chain swaps between EVM and non-EVM blockchains. With over a million total transfers and a total value locked exceeding $28 million, Allbridge Core exemplifies the infrastructure necessary for a cohesive DeFi environment.

You might also like:The path to creating seamless cross-layer interactions | Opinion

Friendly regulation and institutional embrace

The maturation of the stablecoin market is not occurring in a vacuum. Regulatory frameworks are evolving to accommodate and oversee this burgeoning sector. The advancement of the GENIUS stablecoin bill to the U.S. Senate floor signals a significant step towards integrating stablecoins into the U.S. financial system.

The new United States stablecoin bill, known as the “Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act,†introduced by Senators Bill Hagerty (R-TN), Tim Scott (R-SC), Kirsten Gillibrand (D-NY), and Cynthia Lummis (R-WY), represents a significant bipartisan effort to establish a clear regulatory framework for payment stablecoins. This legislation aims to bolster blockchain innovation in the United States by providing comprehensive guidelines for licensing, oversight, transparency, reserve standards, consumer protection, and compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. By defining payment stablecoins as digital assets pegged to a fixed monetary value and used for payments or settlements, the GENIUS Act seeks to ensure financial stability while promoting responsible innovation in the digital asset space. Such legislative developments provide the clarity and legitimacy necessary for broader adoption.

Institutional players are also taking note. Major financial brands have begun integrating stablecoins into their platforms, recognizing their potential to streamline transactions and reduce costs. This institutional embrace not only validates the utility of stablecoins but also accelerates their adoption among mainstream users. For example, Visa and Stripe-owned Bridge have revealed plans to introduce Visa cards tied to stablecoins, with the goal of enabling crypto-funded payments to function as smoothly as traditional card transactions. Mastercard announced a collaboration with OKX and Nuvei to deliver comprehensive stablecoin payment solutions. The initiative seeks to simplify stablecoin use for both consumers and merchants—from digital wallets to checkout—mirroring the ease of conventional card payments. Mastercard aims to leverage this innovation to enhance the efficiency of money transfers, including payments, disbursements, and remittances.

The vital role of stablecoins in crypto mass adoption

Stablecoins have transcended their initial role as mere digital representations of fiat currencies. They have become integral to the infrastructure of the crypto economy, facilitating transactions, enabling cross-chain interoperability, and attracting institutional investment.

As we navigate through 2025, the trajectory of stablecoins suggests they will continue to be the linchpin in the broader adoption of cryptocurrencies. Their inherent stability, coupled with technological advancements and regulatory support, positions them as the bridge between traditional finance and the decentralized future. For individuals and institutions alike, embracing stablecoins could be the key to unlocking the full potential of the crypto economy.

Read more:The United States SEC’s timely stablecoin guidelines | Opinion

Andriy Velykyy

Andriy Velykyyis a co-founder at Allbridge, an ecosystem of cross-chain solutions. Andriy is a Warwick Business School alumnus, and he entered the crypto space in 2015. Recognizing the growing need for bridging solutions, he co-founded Allbridge in May 2021 alongside Yuriy Savchenko. Since then, Allbridge has steadily expanded, introducing new non-EVM integrations and advancing cross-chain interoperability. Their flagship product, Allbridge Core, launched in 2022, delivers a more efficient and user-friendly approach to bridging.

2025-05-13 18:34:01

浏览量27

浏览量27