1 月 20 日,比特币创下 109,114 美元的历史新高。然而,比特币并没有激发进一步上涨的希望,反而面临持续的抛售压力,截至本文撰写时,比特币价格已从峰值下跌约 20%。最近几周,比特币需求疲软,增持势头减弱,短期投资者的恐慌情绪加剧。

At Outset PR, we observe that such corrections are not uncommon in Bitcoin’s historical cycles, often driven by shifts in liquidity, derivatives market positioning, and investor sentiment. Below, I’ll look into the ongoing Bitcoin liquidity trends, derivatives market activity, and holder cohorts’ behavior to see whether the original cryptocurrency has already peaked for this cycle or is going through a temporary correction.

Table of Contents

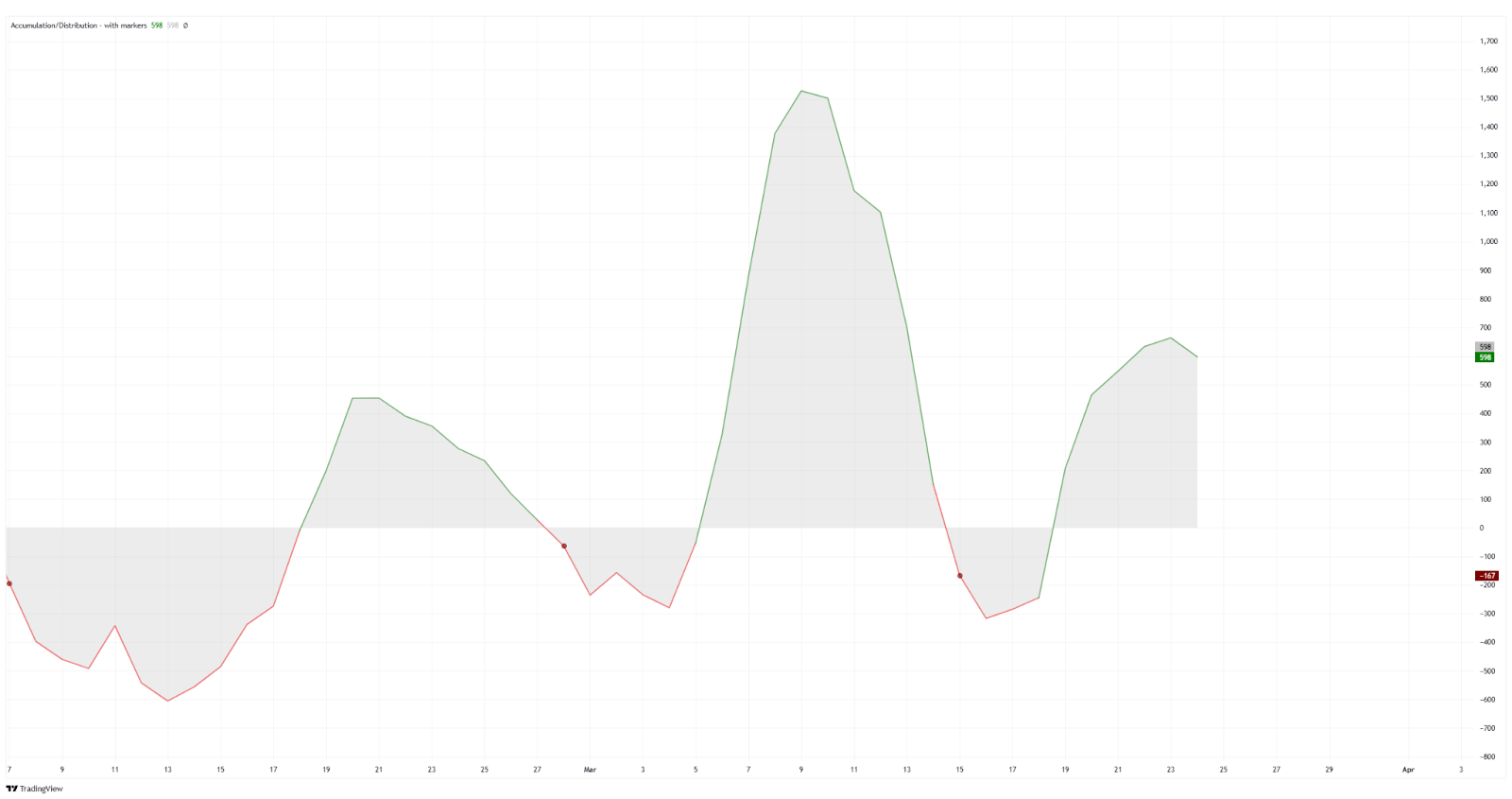

Bitcoin’s market cycles are driven by phases of accumulation and distribution. While a clear distribution phase emerged in late February 2025, recent movements in the Accumulation/Distribution (A/D) Indicator reveal a strong cycle of accumulation followed by intense selling pressure over the past few weeks.

After hitting its lowest point in mid-March, the indicator is now rebounding, suggesting that accumulation is resuming. Historically, such rebounds in the A/D Indicator have often preceded periods of price stabilization or recovery. However, whether this marks the beginning of a sustained accumulation phase or just a temporary bounce remains to be seen.

Further confirming this trend, spot trading volumes on centralized exchanges dropped by 19.9%, and derivatives trading volumes declined by 20.9%, according to the February 2025 CoinDesk Data’s Exchange Review. Additionally, open interest on derivatives exchanges fell by 29.8%, the lowest since November 2024.Â

The situation worsened after the Bybit hack, which resulted in a $1.4 billion loss, amplifying sell pressure and discouraging accumulation as liquidity concerns and market uncertainty intensified.Â

持续的流动性收缩——市场在调整期间的典型行为——是比特币难以创下新高的主要原因之一。根据 Glassnode 的数据,比特币的净资本流入停滞不前,实际市值每月仅增长 +0.67%。这意味着市场缺乏必要的新资本流入,阻碍了价格上涨。

此外,活跃交易流动性的关键指标——热供应量从 5.9% 下降到 2.8%,降幅超过 50%。外汇流入也下降了 54%,进一步证实了交易活动正在放缓,需求侧压力正在减弱

在衍生品方面,比特币期货的未平仓合约已从历史最高水平的 570 亿美元下降至 370 亿美元(-35%),表明投机兴趣和对冲活动减少。

Glassnode 数据还显示,短期持有者的 30 天滚动损失总额已达到 70 亿美元,标志着本周期最大的持续亏损事件,但仍低于 2021 年 5 月的崩盘和 2022 年的熊市。

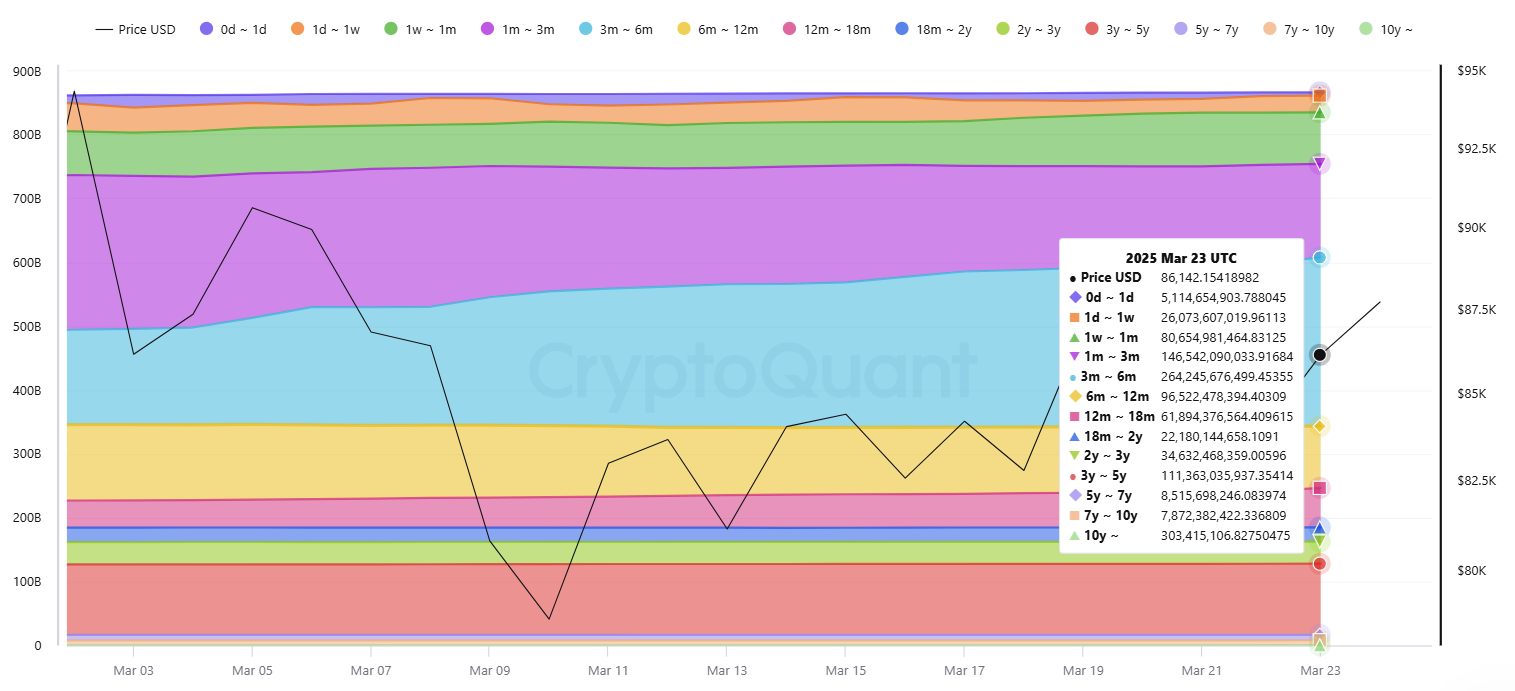

CryptoQuant 的已实现市值 – UTXO 年龄带,追踪自上次移动以来按年龄计算的货币美元价值,显示比特币的已实现市值很大一部分由长期投资者持有。

截至 2025 年 3 月 23 日,各年龄段已实现上限的细分情况如下:

We can see that UTXOs in the under one-week range total $31.2 billion, accounting for just 2.7% of the total realized cap. This indicates that while short-term trading exists, it is not the primary force driving the market. The low proportion of newly moved coins suggests that most recent buyers are still holding their positions, and many participants are not capitulating.

In contrast, the 3–6 month cohort now holds the largest share of Bitcoin’s realized cap at $264.2 billion. This cohort has remained largely unmoved through recent price swings, further reinforcing long-term conviction in the market.

值得注意的是,已持有超过 10 年的比特币价值达 3034 亿美元,是所有年龄段中最大的单一实现价值。

综合来看,当前的 UTXO 年龄分布支持看涨的积累叙事,长期持有者依然充满信心,投机性抛售受到抑制,总体供应继续收紧——这些条件在历史上为强劲的价格复苏奠定了基础。

2025 年 3 月 5 日至 21 日的最新 ETF 数据凸显了混合信号,一些 ETF 经历强劲资金流入,而另一些 ETF 则继续面临大量资金流出,这表明虽然比特币的价格走势仍然面临压力,但长期机构兴趣正在支撑市场情绪。

比特币正在经历一个复杂的后历史高点环境,短期逆风和长期强势交织在一起,这一点显而易见。随着资本流入放缓和投机活动减少,现货和衍生品市场都出现了流动性收缩。然而,累积正在反弹,UTXO 年龄数据显示长期持有者信心强劲,短期抛售较少,尽管波动性较大,但机构资金流继续青睐比特币,几只主要 ETF 均出现净流入。虽然价格压力持续存在,但这些潜在动态表明,当前阶段可能代表健康的盘整,而不是当前牛市周期的结束。

披露:本文不代表投资建议。本页内容和材料仅供教育之用。