WBT, the utility token of the crypto exchange WhiteBIT, emerged as the top-performing coin today, defying the broader bearish market trend triggered by Israel’s attack on Iran earlier today.

According to data from crypto.news, WhiteBIT Coin (WBT) rallied for the third straight day, hitting a new all-time high of $34.3 on June 13 afternoon Asian time. As of press time, its price has settled at $33.67 with a market cap of $4.85 billion, ranking it as the 33rd among the top 100 cryptocurrencies by market cap.

WBT retained some of its past day gains as the broader crypto market was reeling from Israel’s launch of a major military attack against Iran early morning on June 13, in response to which Iran has promised to take retaliatory measures of its own.

Bitcoin (BTC) dropped about 5% to an intraday low of $103,081, while major altcoins like Ethereum (ETH), XRP (XRP), Solana (SOL), and Dogecoin (DOGE) saw losses between 6%-10%, with crypto liquidations soaring 125% to $1.2 billion in a day.

One key factor driving WBT’s gains today is its announcement of a spot listing for the HOME token, which powers the DeFi App platform, while also adding a HOME-PERP pair to its futures section, drawing in more traders and boosting volume.

WBT also gained investor interest as the exchange teased an upcoming partnership with an undisclosed European football club.

On-chain activity further supports the bullish sentiment. Data shows a 580% spike in daily active addresses, a strong sign that more users are interacting with the WhiteBIT ecosystem.

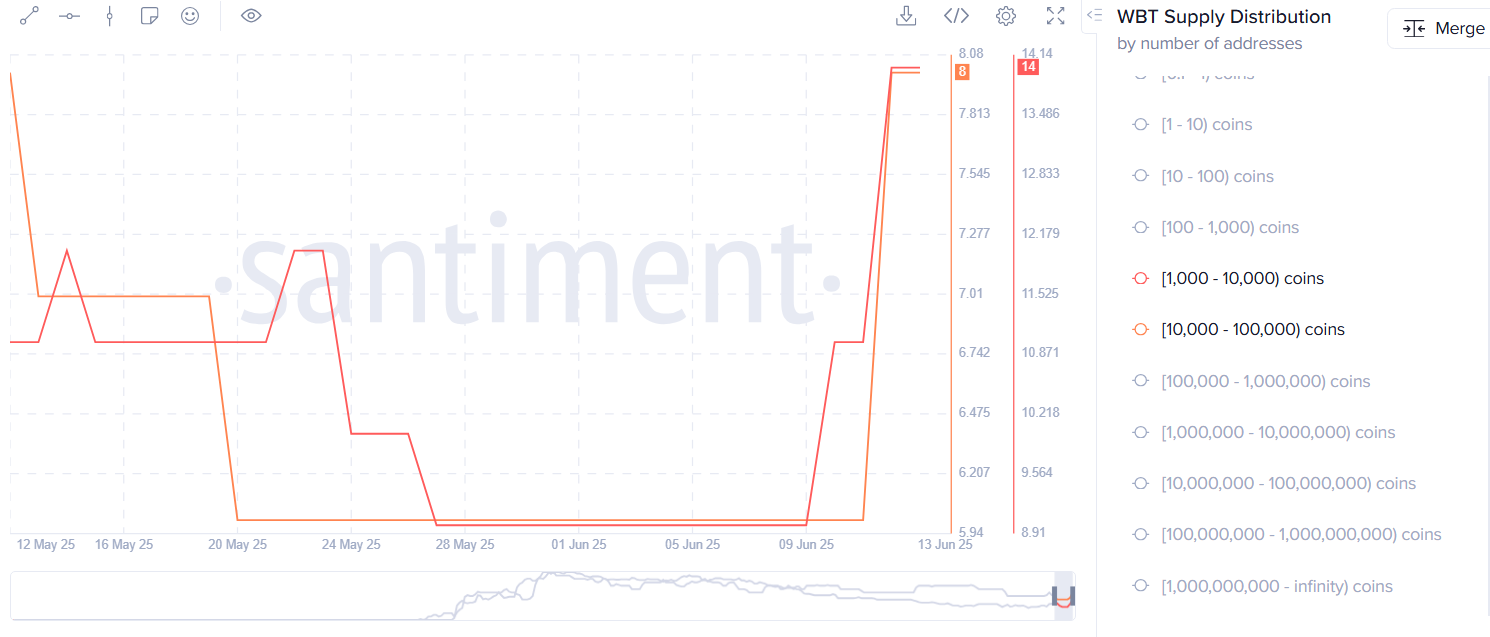

Meanwhile, Santiment reported a notable increase in whale accumulation, indicating that large holders are buying up WBT. This kind of activity often signals confidence in the token’s longer-term potential and can amplify price momentum during bullish phases.

At press time, WBT had shed some of its gains but still managed to retain its position as the highest gainer among the top 100 cryptocurrencies, with bullish momentum continuing to outweigh broader market selling pressure.

On the 1-day USDT chart, WBT looks to have been forming an ascending broadening wedge pattern since early May, typically a sign of increasing volatility within an uptrend.

The Aroon Up indicator is currently at 92.86%, while Aroon Down is at 28.57%, showing that bullish momentum is still in play. The MACD lines are also pointing upward, adding to the positive sentiment.

If this momentum holds, WBT could climb toward the key psychological level of $35. A clear breakout above that would confirm the bullish pattern and may encourage bulls to aim for $38 next, marking a 13% gain from current prices.

On the contrary, if market risk sentiment weakens due to escalating macro tensions, the nearest support level to watch would be around $31, where traders previously stepped in to buy the dip.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.