Bitcoin maxis say, “Never sell your Bitcoin.†They repeat it when the market crashes to urge people not to dump their BTC in a loss out of panic and fear. They repeat it when the price is going up because they believe that no matter how high the cost is in relation to previous levels, it is still negligible in comparison to the future levels. So if they never sell, why do they care about its price (oh, they do)?

Table of Contents

The term “hodl†is one of the staples of hardcore bitcoiners. It is a misspelled word “hold.†The history behind the term captures the spirit of the “Never sell your Bitcoin†attitude pretty well.Â

The “hodl†term dates back to a 2013 thread on the Bitcointalk forum. The original post was written by a tipsy hobby investor using a GameKyuubi moniker. His message titled “I AM HODLING†was a rant perfectly lousily worded amidst the Bitcoin price downfall (and the OP’s untimely tiff with a girlfriend).

In the message, GameKyuubi calls himself a bad trader and reveals he will hold Bitcoin instead of trying to time the market as good traders do.Â

“You only sell in a bear market if you are a good day trader or an illusioned noob. The people in between hold. In a zero-sum game such as this, traders can only take your money if you sell.â€

GameKyuubi’s post struck a nerve, and folks on the forum responded to it with multiple urges to HODL, a meme (and a term used until the present day) was born.

If we think about GameKyuubi’s message, we’ll see that he wasn’t against taking profits at all. He just didn’t know when to sell his bitcoins in exchange for fiat money, so he decided not to do that to avoid being “a bad trader.â€Â

Many interpret the “Never sell Bitcoin†principle not literally. In one of the discussions on the topic on Reddit, many bitcoiners admitted that they just don’t exchange their bitcoins for dollars. Instead, they continue to buy more Bitcoin and hold it until they need a substantial amount of money. They may sell their BTC if they buy a car or make other costly purchases. Some spend their sats to pay their rent but leave the rest of the profits in Bitcoin and don’t plan to sell it. So, they think that it’s better to hold money in Bitcoin rather than in fiat money. Bitcoin is a savings currency for them, as they believe in Bitcoin’s long-term price appreciation. It’s understood that for these people, Bitcoin’s price is an important metric, even if they haven’t sold it for years.

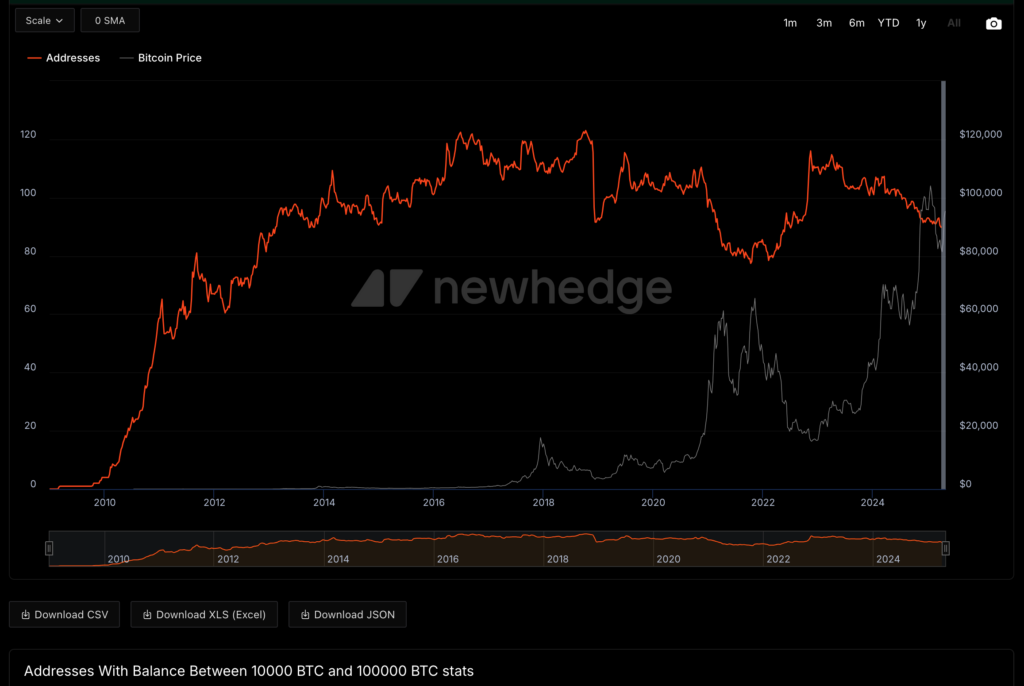

Whales are the holders of large crypto bags worth millions. In the 2020s, the Bitcoin price trajectory became heavily influenced by whale transactions. The chart indicating the correlation between Bitcoin price and the number of transactions made by the wallets holding over 10,000 BTC looks almost like mountains reflected in the lake–whenever the amount of whales’ transactions goes up, the price goes down, and vice versa. These curves may seem inverted in relation to each other.

If we take a closer look at the segment where GameKuubi writes, “In a zero-sum game […], traders can only take your money if you sell,†we may see the reflection of another popular motto: “Never sell your Bitcoin to whales.†Whales will buy your bitcoins at any price at any time. However, the chances you will be able to re-purchase what you sold are small as Bitcoin’s price keeps on moving up, and whales are not avid sellers.Â

Michael Saylor of Strategy is probably the most radical follower of the “Never sell your Bitcoin†creed. His company follows the “Bitcoin standard†and sells its shares and takes on debt while buying more and more Bitcoin. Strategy (formerly MicroStrategy) has been buying Bitcoin since 2020. It already holds over 500,000 BTC (over 2.5% of the total supply), and Saylor claims he will never sell Bitcoin. Once, he said that destroying the keys from the wallets with substantial amounts of Bitcoin was not a bad idea.Â

Saylor urges corporations and the U.S. government to use his blueprint and start accumulating Bitcoin. According to him, those who control the biggest share of the total 21,000,000 units of Bitcoin will have the most influence in the future.Â

This vision suggests that the price of Bitcoin is not as important as having as much bitcoin as possible (“we are still early,†“Bitcoin is still undervaluedâ€). It is reflected in the randomly looking dates of Strategy’s purchases of huge amounts of Bitcoin, often on the “wrong†days when the price is high (for this, Saylor was even jokingly called “one of the worst crypto traders in modern historyâ€). However, the price of Bitcoin is still important for the company as it affects the value of Strategy’s shares (MSTR) and the further planning of the Bitcoin-based strategy.

According to Saylor, if the BTC price drops to $1, he will just buy all the bitcoins. Having one of the biggest stacks of bitcoins and having no intention to sell it draws broad philosophical questions like what it means to be rich. However, let’s leave it at this.