Bitcoin price has dropped into a bear market this year after falling by 23% from its highest point in January.

Bitcoin (BTC) was trading at $84,555 on Good Friday, up by 13% from its lowest point this year, giving it a valuation of over $1.68 trillion. It has dropped by 10% this year, outperforming the Nasdaq 100 index, which has fallen by 13%.

Historical data suggests that Bitcoin remains in a bullish trend despite the 23% dip. Moreover, the coin has experienced bigger drops in the past. For example, it fell by 35% from its peak in March last year to its lowest point in August, before bouncing back.

比特币此前也曾多次出现深度下跌。由于美联储加息以及 Celsius、Terra 和 FTX 等几家知名加密货币公司的倒闭,比特币价格从 2021 年 11 月的 68,980 美元跌至 2022 年的最低水平。

因此,尽管目前的回调趋势可能持续,但由于其基本面依然强劲,比特币仍有可能反弹。比特币挖矿难度已达到历史最高水平,导致新币上线数量减少。

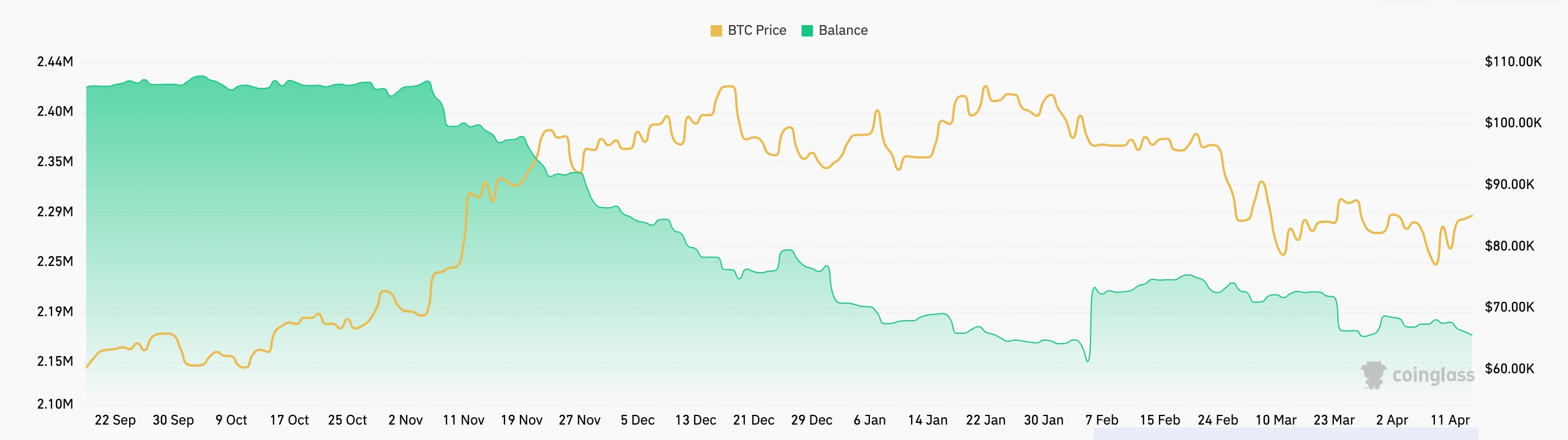

此外,数据显示,交易所的比特币数量持续下降,表明许多持有者并未抛售。目前,交易所的比特币数量为 218 万枚,低于去年 9 月份的 244 万枚。

Another possible signal for Bitcoin is the recent gold surge. Gold has soared by over 25% this year to reach its all-time high. According to one crypto analyst, Bitcoin usually follows gold with a 100- to 150-day lag.

The weekly chart shows that BTC price is still in an uptrend despite the recent retreat. It has found support at the 50-week Exponential Moving Average, where it has failed to move below several times since October 2023.

Bitcoin has also remained above the Ichimoku Cloud indicator, a bullish sign. It has also moved above the key point at $73,685, the upper side of the cup-and-handle pattern which is a popular continuation signal.

This cup had a depth of 78%. Therefore, measuring the same distance from the cup’s upper side points to more gains to $123,585. This price is about 45% above the current level. A drop below the key support at $73,685 will invalidate the bullish outlook.