Uniswap 的价格在过去几个月中有所回落,最近形成的死亡交叉模式表明可能进一步下跌。

Uniswap (UNI) token was trading at $10 on Tuesday, down over 50% from its peak in November. This decline coincided with Bitcoin’ (BTC) stalled rally and a broader altcoin bear market.

Uniswap has been losing market share in the decentralized exchange industry, where it was once the dominant player. According to DeFi Llama, Uniswap has handled $100 billion in trading volume, now trailing PancakeSwap’s $109 billion. Additionally, Uniswap has lost market share to Raydium, the largest DEX on Solana (SOL).

与此同时,最近推出的 Unichain 主网起步缓慢。DeFi Llama 的数据显示,Unichain 已吸引 12 个 DeFi 网络加入,总锁定价值达 862 万美元。生态系统中最大的 dApp 是 Stargate、Uniswap、Venus 和 DyorSwap。

Uniswap 旨在将 Unichain 定位为用户交易的主要网络,因为它的费用较低且兼容多链。

尽管面临这些挑战,Uniswap 仍然是 DEX 行业中最赚钱的参与者。根据 TokenTerminal 的数据,Uniswap 今年产生的费用为 1.86 亿美元,远高于 PancakeSwap 的 7100 万美元。

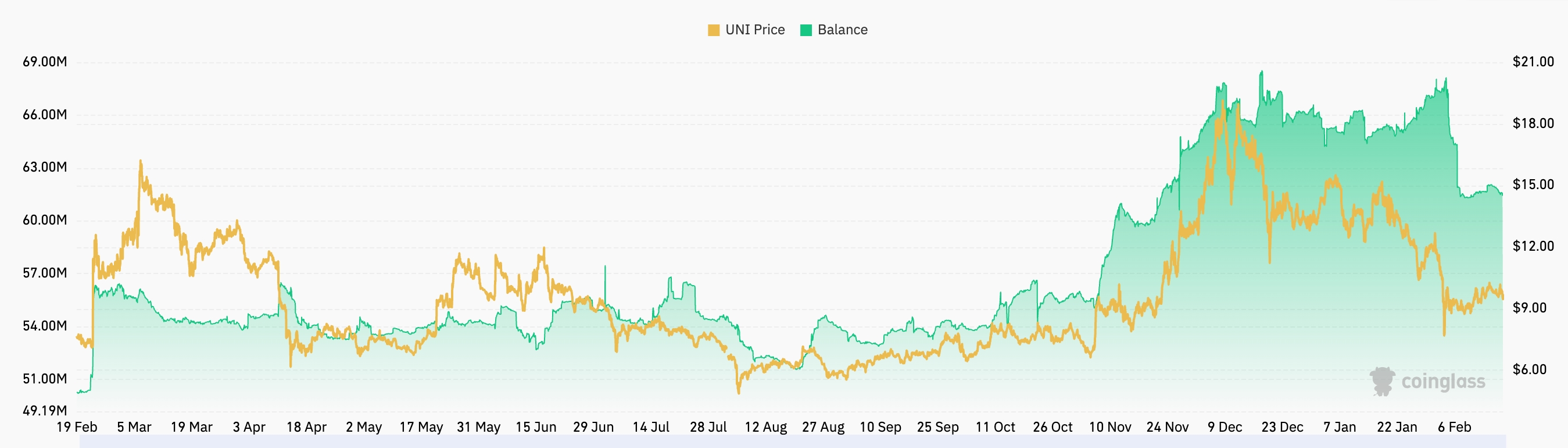

Another positive indicator is the decline in UNI token balances on centralized exchanges. The number of UNI tokens held on exchanges has dropped from 67 million earlier this month to 61 million. A decline in exchange balances suggests reduced sell pressure and increased investor confidence.

日线图显示,UNI 在去年年底达到 19.44 美元的峰值,随后跌至 10 美元。该代币现已形成死亡交叉,50 天和 200 天加权移动平均线已翻转,这是技术分析中的关键看跌延续信号。

此外,Uniswap 已形成看跌旗形模式,即急剧下跌后盘整。该代币还跌破了 61.8% 斐波纳契回撤水平,这是经常出现反弹的关键区域。

鉴于这些看跌信号,下一个值得关注的关键支撑位是 7 美元,这是本月的最低水平。然而,如果 UNI 升至 200 日移动平均线 11.20 美元上方,看跌前景将失效。