由于贸易不确定性,交易员纷纷远离美元,以欧元为基础的稳定币市场正在增长。

欧洲稳定币市场正在逐渐脱离美元。4月15日(周二),Circle的EURC稳定币发行量创下历史新高,达到2.48亿美元。供应. This makes it the largest euro-denominated stablecoin in circulation, putting it ahead of USD-based stablecoins such as USDG.

The growth coincides with rising concerns about the EU’s trade relations with the U.S. amid ongoing tariff tensions. Traders, especially those in Europe and Asia, are increasingly opting for alternatives to the U.S. dollar that are less exposed to geopolitical risks.

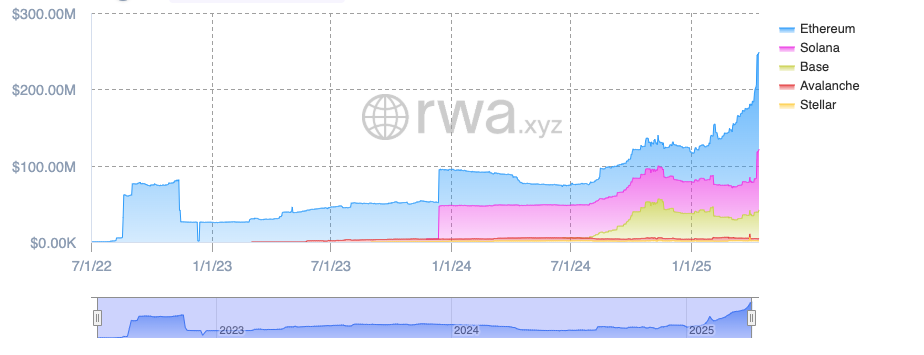

EURC 超过一半的供应量(约 1.27 亿美元)在以太坊网络上。Solana 以 7900 万美元位居第二,Base 则占 3700 万美元。Avalanche 和 Stellar 的份额较小,均低于 300 万美元。

欧元区增长的最大推动因素之一是美元兑欧元贬值。美国与其主要贸易伙伴之间持续的紧张关系加剧了宏观经济的不确定性,尤其是在通胀方面。

自1月以来,美元兑欧元大幅下跌,从0.98美元跌至0.88美元,主要原因是持续的关税担忧。美元兑欧元的相对下跌有助于提升欧元稳定币的吸引力和市场份额。

EURC has also benefited from its full compliance with the European Union’s strict MiCA stablecoin regulations. Notably, MiCA’s transparency and reserve requirements forced Tether’s USDT and EURT out of the European market. With USDT being the largest stablecoin globally, this shift has prompted some European investors to favor a euro-denominated option instead.

Still, despite EURC’s relative rise, it is important to note that USD-backed stablecoins still dominate the market. USD-backed stablecoins currently account for 99% of the $226 billion in global stablecoin supply. Tether’s USDT controls 63%, or $143 billion.