美国通胀率在 3 月份下降,引发了人们对美联储将在即将召开的会议上采取更为温和基调的乐观情绪,从而推高了加密货币价格。

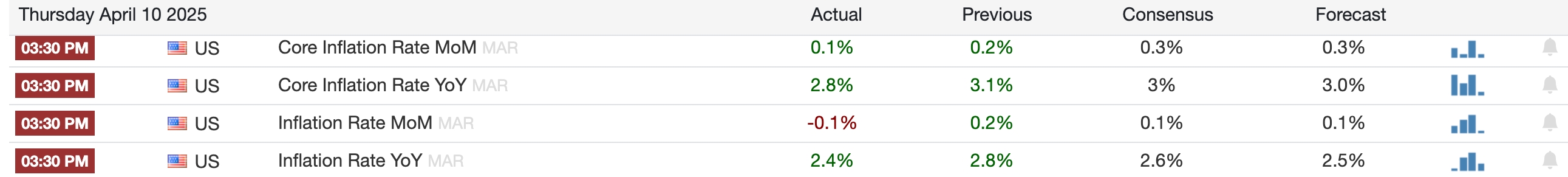

美国劳工统计局的数据显示,3月份消费者物价指数从2月份的0.2%下降至-0.1%。同比来看,通胀率从2.8%下降至2.4%,有望达到美联储2.0%的目标。

The closely watched core CPI, which excludes volatile food and energy prices, also dropped from 0.2% to 0.1% month-over-month, pushing the annual core figure down to 2.8%. This marked the first time in years that core CPI fell below 3%.

The decline in inflation came despite the implementation of new U.S. tariffs on imported goods. President Donald Trump raised tariffs on Canadian and Mexican imports to 25%, disrupting the USMCA deal he negotiated during his first term. He also increased tariffs on Chinese goods by 20%.

此外,美国还对用于建筑和制造的进口钢铁和铝实施了新的关税。

因此,最新的通胀数据可能会加大美联储重启降息的压力。通胀下行趋势可能会持续,尤其是在特朗普暂停对大多数国家征收“解放日”关税之后。

The US inflation data came as Bitcoin (BTC) and most altcoins like Ethereum (ETH) and Ripple (XRP) bounced back from their weekly lows. Bitcoin rose and stalled at $82,000, while Ethereum and XRP rose to $1,600 and $2, respectively.

U.S. stocks also rallied following Trump’s decision to pause some tariffs and instruct trade representatives to begin negotiations with over 70 countries. However, he raised tariffs on Chinese imports to 125%, putting over $500 billion worth of goods at risk.

This decision led to a sharp decrease in recession odds. Goldman Sachs, which boosted its recession odds earlier this week, was the first Wall Street bank to scale it down. A Polymarket poll with over $2.2 million showed that there was a 50% chance of a recession, down from this week’s high of 66%.

Falling inflation, especially as economic growth slows, could push the Fed toward cutting interest rate, an outcome that would serve as a bullish catalyst for Bitcoin and other altcoins. For instance, the crypto bull run that began in early 2023 was fueled in part by expectations that the Fed would ease monetary policy as inflation declined.