MOVE 与恶意做市商分道扬镳后飙升至 2 个月高点,这引发了鲸鱼们的再次兴趣。

据 crypto.news 数据显示,3 月 26 日亚洲时间下午,Movement (MOVE) 飙升 32%,盘中最高达到 0.594 美元,市值达到 13.6 亿美元。其日交易量也在此期间飙升了 7 倍,达到约 8.29 亿美元。

今天的大部分收益是在运动网络基金会宣布从一位现已被禁止在币安运营的做市商手中收回了约 3800 万美元的 USDT 之后获得的。

该实体最初被引入的目的是通过下达买卖订单为平台上的 MOVE 提供流动性,以帮助稳定价格并支持健康的交易。然而,做市商却变得恶意,在代币在币安上市后不久就抛售了 6600 万个 MOVE 代币,而几乎没有下达任何买单。

币安将此行为标记为“市场违规行为”,冻结了做市商的利润,并将其从平台上移除。

运动基金会已与该公司断绝关系,并承诺向为期三个月的回购计划“运动战略储备”投入全部 3800 万美元。基本上,他们将从公开市场购买 MOVE,以缓解抛售压力,并为生态系统注入更多流动性。

回购消息引发了鲸鱼囤积浪潮。

3 月 24 日,持有 1 亿至 10 亿 MOVE 的钱包中约有 5.53 亿个代币。截至今日,这一数字已飙升至 9.53 亿,这意味着鲸鱼在过去 48 小时内抢购了约 4 亿个 MOVE。按当前价格计算,这些代币价值超过 1.85 亿美元。

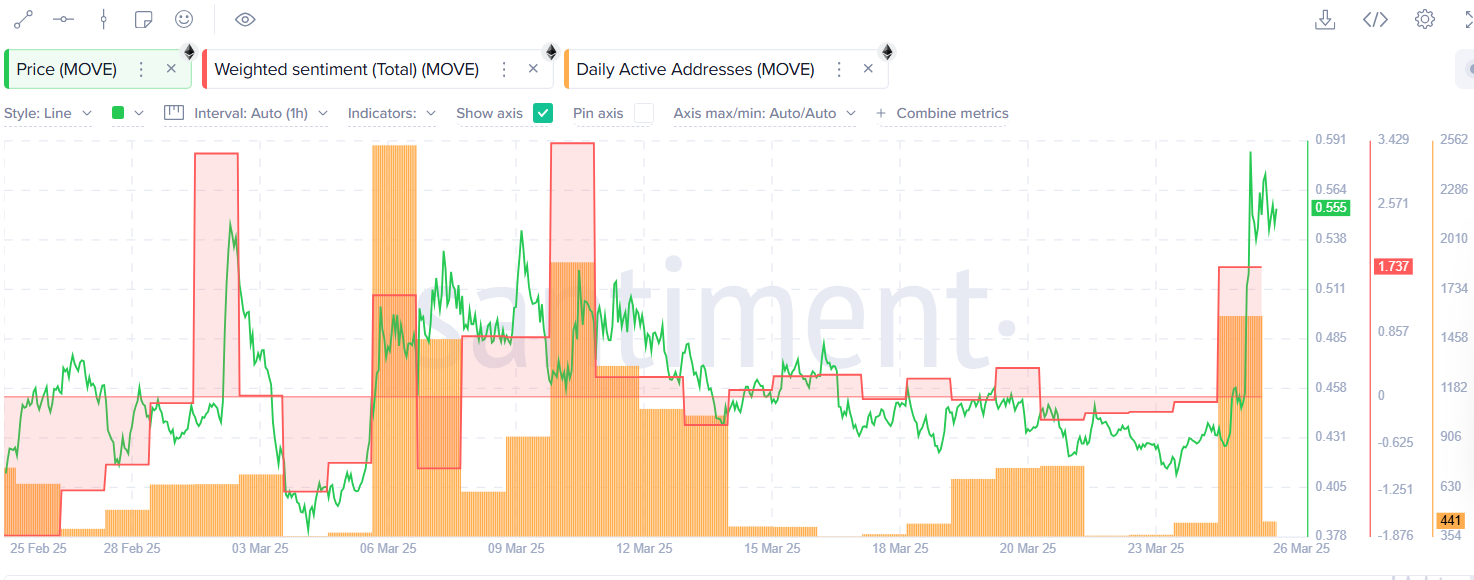

链上指标也表现强劲。每日活跃地址激增 265%,社交情绪在过去一天转为积极。

在 1 天/USDT 价格图上,MOVE 已经突破了持续数月的下跌楔形模式,这通常是看涨反转信号,可能意味着未来会有更长的上涨。

MACD 和超级振荡线均指向上方,这证实势头正在转向有利于多头,并指向短期内进一步上涨。

Additionally, the Money Flow Index stood at 65, showing that buying pressure is picking up, but there’s still room for more before it hits overbought territory.

Given these positive signs, MOVE could rally to its psychological resistance at $0.90, 65% above current levels. This has also acted as a key resistance level for the altcoin. A break above this mark could push it to target its yearly high of $1.12.

However, if MOVE breaks below the lower trendline of the wedge, the setup might be invalidated. In that scenario, the altcoin’s value might sink to $0.37.

披露:本文不代表投资建议。本页内容和材料仅供教育之用。