Bitcoin, Ethereum, and XRP face carnage in response to Trump’s policies and announcements. The total market capitalization of crypto is down to $2.784 trillion on Wednesday.Â

比特币(BTC)与标准普尔 500 指数的 30 天相关性为 0.75,这向交易员发出信号,表明顶级加密货币的表现与美国股票相似。特朗普主义,或者说美国总统唐纳德·特朗普在某一天的某个特定时刻对某个主题的看法,在他执政的头五十天内引发了加密货币的大幅回调。

目录

U.S. stocks are facing a slump, the S&P 500 is down nearly 8% in the past month, and is lower than it was the day before President Trump won the 2024 election. $4.5 trillion in capital has been wiped out of the market, per the index, and the correction is not limited to equities.Â

Crypto, typically considered one of the high volatility risk assets, has faced a steep decline as traders turn risk averse and pull capital from the category.Â

尽管美国股市表现是新政府上任后前 50 天内有史以来最差的表现之一,但即使在调整后,加密货币市值仍比选举前的水平高出近 20%。

当比特币突破 10 万美元大关并创下历史新高时,以太坊和 XRP 也随之上涨。根据 TradingView 的数据,这场市场大屠杀导致三大加密货币下跌,过去一个月分别下跌了近 15%、28% 和 9%。

特朗普的亲加密货币行政命令和战略加密货币储备公告未能激发交易员的积极情绪。Alternative.me 的加密货币恐惧与贪婪指数显示,交易员在周三仍然感到恐惧。

在 2 月份的一份报告中,《福布斯》评估了唐纳德·特朗普重返总统宝座对数字资产等另类投资的影响。该出版物概述了这取决于“政策实施的细节、市场预期和全球经济状况。虽然一些行业可能会受益于放松管制或税收激励,但其他行业可能会面临政府支持的减少或政策转变。”

Traders, therefore, need to proactively switch strategies and adjust portfolios, trade headline to headline, and anticipate the potential changes, such as the inclusion of different tokens in the U.S. Strategic Crypto Reserve, to prioritize categories of tokens that are likely to receive favorable treatment or have inherent resilience to policy-induced volatility.

在经历了连续近四周的调整后,加密货币市场和三大代币本周继续下跌。随着加密货币交易员消化特朗普的关税战和行政命令,机构和市场参与者已转向规避风险,并意识到比特币的损失正在增加。

BTC 现在正处于一个十字路口,随着交易员推动对风险资产的需求上升,金融宽松可能意味着加密代币上涨。然而,地缘政治逆风和特朗普主义继续对该行业造成沉重压力。

The debate on whether a Strategic Crypto Reserve would meet the expectations of the crypto community and what the inclusion of Ethereum (ETH), XRP (XRP), Solana (SOL), and Cardano (ADA) means for holders of the token wages on social media platforms.Â

Traders now wait and watch for the narrative to unfold. It is typical for the Bitcoin price to drop between 20 and 25% before it rallies during a bull market. However, the macroeconomic headwinds and higher number of market movers make it challenging to predict BTC price trends in the coming weeks and months.Â

The $80,000 level remains a crucial support for Bitcoin; a return to the $100,000 milestone could see BTC rally towards its all-time high and test it. However, a decline from $80,000 could push the token to pre-election levels under $70,000.Â

Another 15% drop from the current price level could erase all post-election gains for Bitcoin.Â

以太坊价格比选举前的水平低 30%,回到了 2023 年 11 月的价格。多种因素,缺乏机构兴趣、对以太坊基金会内部变化的担忧、以其持有的以太币作为抵押品借入稳定币的鲸鱼的清算以及大型钱包交易者的兴趣减弱,都对以太坊价格趋势产生了负面影响。

在撰写本文时,以太币的交易价格为 1,846 美元,交易员正在等待美国证券交易委员会批准等催化剂,以在美国现有的以太币 ETF 中增加质押,从而推动加密货币中最大山寨币的上涨。

XRP 是三大加密货币中最具弹性的,交易价格比选举前的水平高出 75%。在撰写本文时,XRP 的交易价格为 2.1668 美元。

Catalysts like the token’s addition to the U.S. Strategic Crypto Reserve, Ripple executive’s inclusion in Trump’s elite Crypto Summit last Friday, and SEC’s changing stance on litigation against crypto firms have contributed to the gain in XRP price.Â

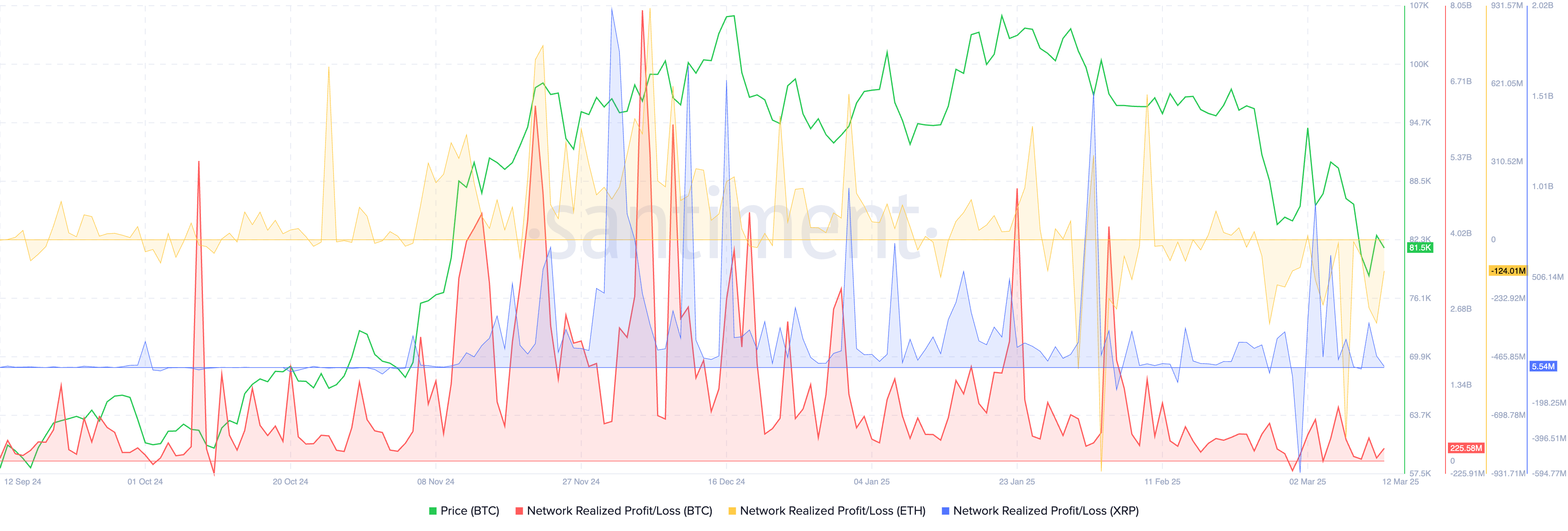

自 2 月中旬以来,比特币和 XRP 交易员一直在获利了结。然而,就以太坊而言,交易员的行为类似于投降。交易员已经意识到他们持有的以太币亏损,因为从 Santiment 的网络实现盈亏指标的负向峰值可以看出。

投降之后价格会稳定下来,但以太币价格是否会在未来几周和几个月内回升还有待观察。

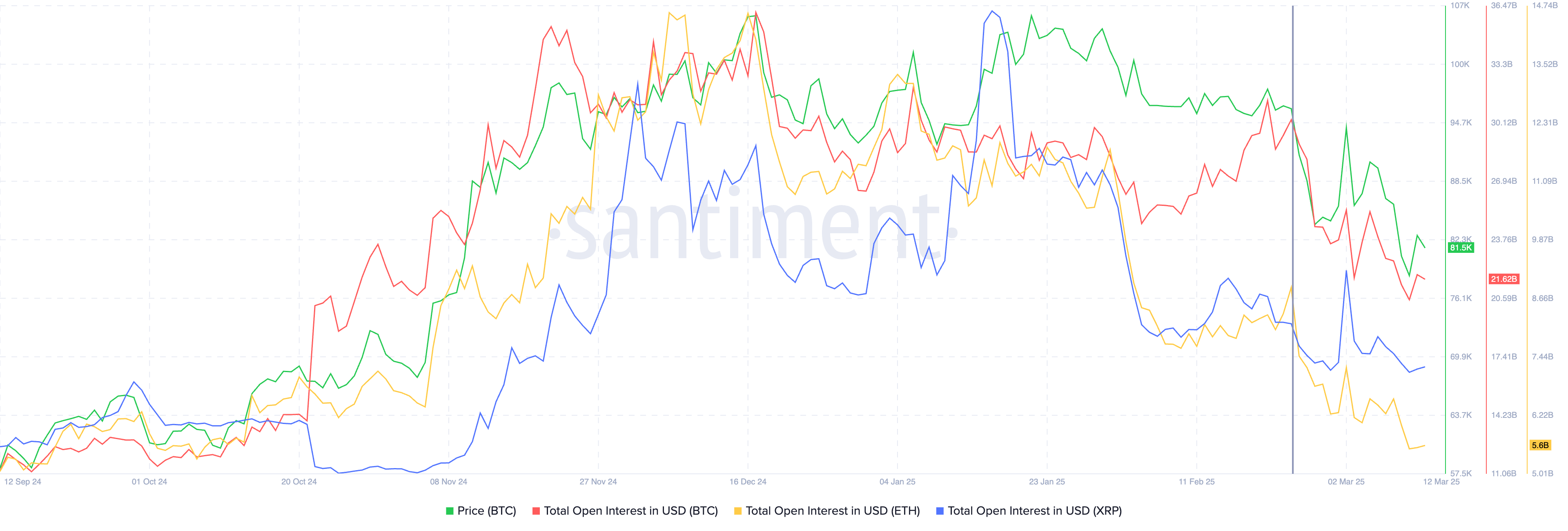

The total open interest in USD in the three tokens has shown a steady decline since the last week of February. This implies that derivatives traders are losing interest in the top 3 cryptos, in line with the risk-off sentiment and the U.S. stock market bloodbath.Â

As Bitcoin behaves more like a U.S. tech stock every day, the “Bitcoin as a hedge and safe haven†narrative takes a hit, and cryptos are identified as one of the risk-assets among alternative investments.Â

X 账号 @davthewave 背后的加密分析师认为,加密市场调整最糟糕的时期已经过去。比特币牛市还远未结束,分析师检查了支持其论点的五个关键指标。

过去三次牛市中,比特币价格的平均回调幅度分别为 2016-17 年、2020-21 年和 2023-24 年的 24% 至 32%。因此,BTC 的近期回调幅度远低于平均水平,并不直接预示着牛市的结束。

加密比特币牛市指数是一种用于分析九种不同统计数据以确定市场周期阶段的指标。PI 周期、MVRV Z 分数和储备风险等指标用于识别比特币牛市还是熊市。

在过去三个周期中,每当 CBBI 超过 90 时,比特币就会创下历史新高。这在当前的周期中尚未发生,这意味着牛市可能会持续,BTC 可能会在 2025 年的未来几个月达到顶峰。

WeFi 增长主管 Agne Linge 与 Crypto.news 分享了书面评论,评论了比特币市场波动性上升,以应对不断变化的宏观条件。

林格说,

“过去两周,比特币在 7.9 万美元至 8.5 万美元之间波动,反映出地缘政治和宏观经济压力不断加大导致市场波动加剧。市场情绪紧张,贸易紧张局势再次升级,预计 4 月 2 日将实施新的关税。今天,对钢铁和铝进口征收 25% 的新关税生效,引发欧盟迅速反击,欧盟计划从下个月开始对价值 260 亿欧元(约合 220 亿英镑)的商品实施反制措施。

宏观波动加剧和地缘政治紧张局势促使投资者转向美国国债等避险资产,反映出在市场不确定性不断增加的情况下,投资者普遍转向资本保值。与此同时,德国决定举债为军事建设提供资金,引发德国政府债券 (Bunds) 大幅抛售,投资者寻求更大的稳定性,这加剧了投资者转向美国国债的趋势。

Bitfinex 分析师告诉 Crypto.news,

“Such widespread capitulation often precedes market stabilisation, though geopolitical and macroeconomic concerns remain a significant overhang.â€

Dr. Sean Dawson, Head of Research at Derive.xyz told Crypto.news:

“The market is facing significant challenges as the macroeconomic environment worsens, and crypto assets are no exception.Â

随着看跌情绪的增强,交易员开始转向下行对冲策略,尤其是在传统市场和加密货币市场波动性激增的情况下。未来几周对于评估更广泛的经济形势如何影响数字资产价格和交易行为至关重要。”

披露:本文不代表投资建议。本页内容和材料仅供教育之用。