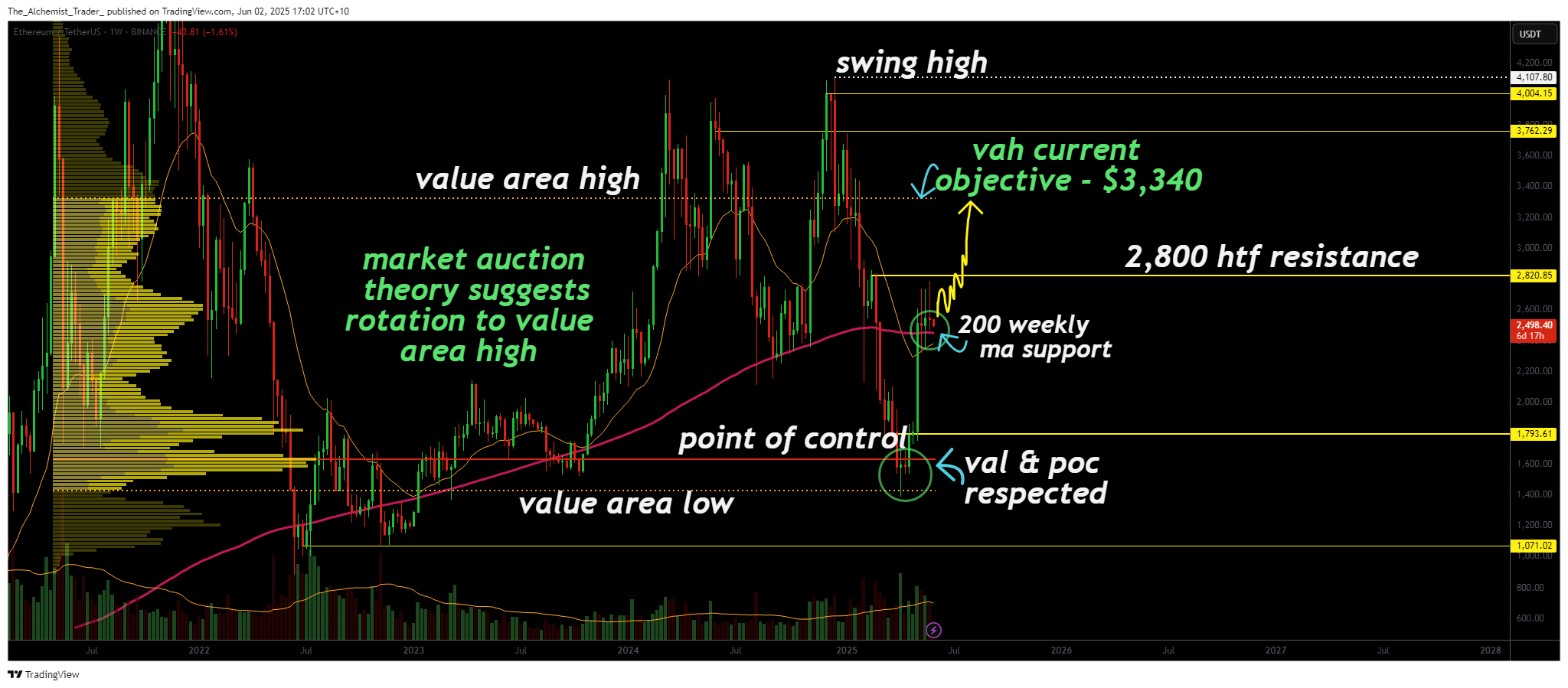

Ethereum is resting above the critical 200-week moving average after breaking out of a major support zone. With volume rising and structure intact, a full market rotation toward $3,340 appears increasingly likely.

The current setup aligns closely with Market Auction Theory, a framework that explains how price tends to rotate between the value area low and the value area high. In Ethereum’s (ETH) case, the value area low was established between $1,400 and $1,600, where price was considered undervalued by market participants.

After testing that zone, ETH rallied with strength, reclaiming the point of control and pushing above the 200-week moving average.

The 200-week moving average is not just a technical indicator, it represents a key level where institutional interest often responds. Ethereum’s ability to hold above it after a strong impulse suggests that the trend is not only intact but may be accelerating. As price consolidates above this level, it builds a base for the next move higher.

Once $2,800 is breached with conviction, the next logical target is the value area high at $3,340. This would complete the full auction rotation as outlined in Market Auction Theory, which describes how price oscillates between areas of perceived value. A clean tap of the value area high would signal that price has reached the “overvalued†end of the spectrum, at least temporarily, before the market seeks new balance.

Supporting this setup is the ongoing influx in volume, particularly after the breakout from $1,600. This suggests that fresh buying interest is still strong, and as long as this momentum continues, Ethereum remains positioned for higher targets. Volume confirms demand, and currently, demand is pressing against resistance.

As long as Ethereum continues to hold above the 200-week moving average and eventually breaks through the $2,800 resistance with strong volume, the path toward $3,340 remains technically valid. A full market auction rotation appears highly probable in the short to mid-term.