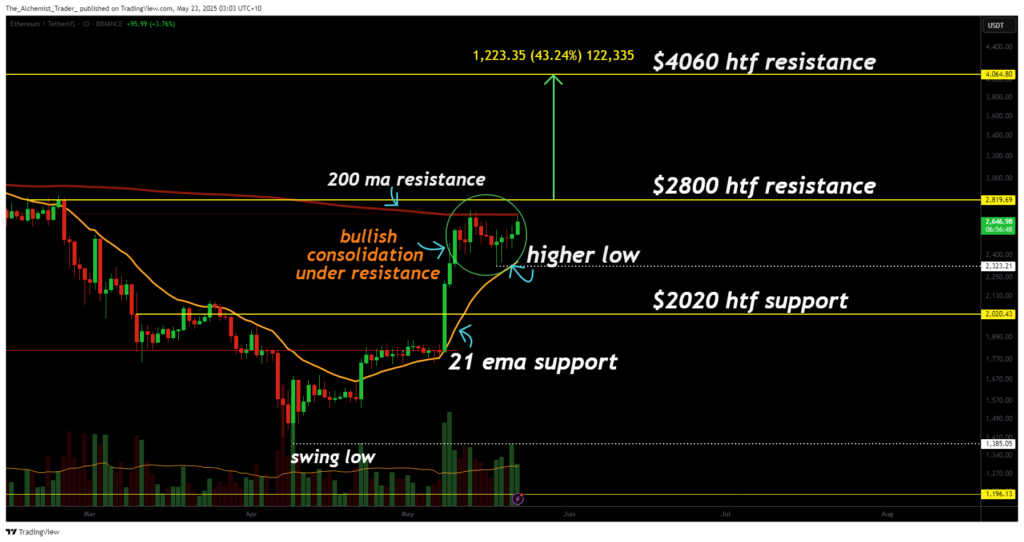

Ethereum is showing strong bullish momentum beneath the key $2,800 resistance level, with consolidation supported by higher lows and critical moving averages. If price breaks above this level, the next upside target lies at $4,060, marking a potential 43% gain.

Ethereum (ETH) is demonstrating strong bullish momentum just below the high-timeframe resistance level at 2,800 dollars. The price has continued to form higher lows despite a recent rejection from the 200-day moving average.

Consolidation is supported by the 21-day exponential moving average, indicating buyers remain active on dips. If Ethereum breaks above 2,800 dollars with volume confirmation, the next upside target sits at 4,060 dollars, a move that would represent a potential 43 percent gain from current levels.

Ethereum has gained 4.47 percent in recent sessions, forming a clear series of higher lows. This bullish structure, building just below a major resistance level, is typically a sign of mounting pressure and potential breakout energy.

The 21EMA continues to provide dynamic support, with price repeatedly bouncing off this moving average. Despite the earlier rejection at the 200-day moving average, ETH established a new higher low, reinforcing its bullish structure.

Price remains compressed beneath the 2,800 dollar resistance. A break and sustained close above this level, especially with strong volume, could catalyze a rapid move toward 4,060 dollars. There is little resistance between these two price zones, which further supports the possibility of a swift rally once the breakout is confirmed.

If Ethereum maintains its current bullish structure and breaks above the 2,800 dollar resistance with solid volume confirmation, a rally toward the 4,060 dollar level becomes increasingly likely. Traders should look for continued higher lows and a strong daily candle close above resistance to validate the breakout.