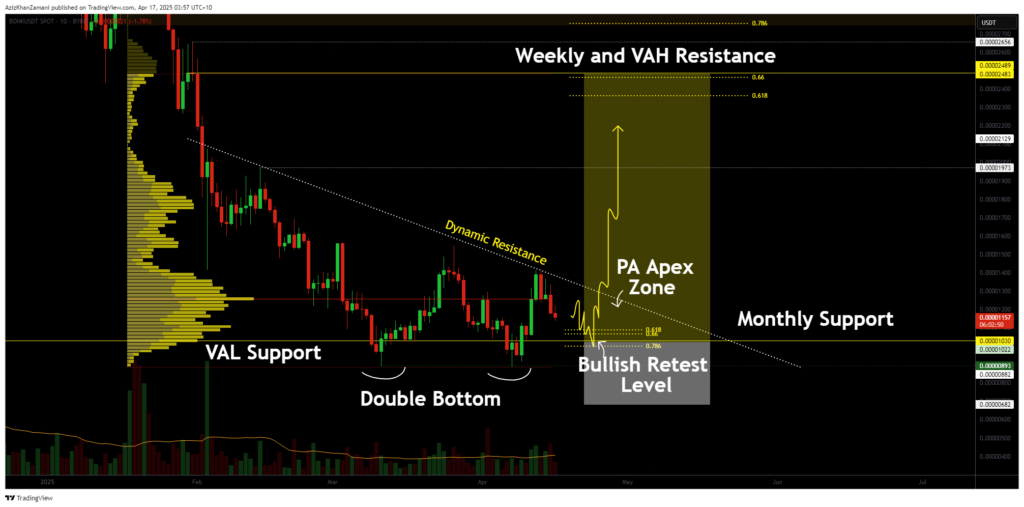

BONK is trading at a key high time frame support level while showing signs of a potential trend reversal. A double bottom formation is developing, and a breakout above dynamic resistance could confirm a shift in market structure, setting the stage for a bullish rally.

After a prolonged bearish trend marked by consecutive lower highs and lower lows, BONK (BONK) is now trading at a crucial decision point. The asset has respected a significant support level twice, forming what may develop into a double bottom formation. However, confirmation is still pending and depends on the next few weeks of price action. The market now awaits a breakout from the apex zone, where resistance and support are converging tightly.

价格走势反复试探价值区域低点支撑位,并出现两次显著反弹。这为双底形态的形成创造了可能性,而双底形态通常被视为经典的反转信号。然而,如果没有出现看涨的更高低点并突破,该形态仍未得到确认。

Currently, price is squeezing into an apex zone, a point where monthly support and dynamic resistance converge. This tightening price action often precedes major directional moves. For BONK, a break above the dynamic resistance line would mark a structural shift from bearish to bullish on the daily time frame. This would confirm the double bottom and suggest the downtrend is potentially over.

For the breakout to hold validity, volume confirmation is crucial. A strong move through resistance, supported by increased volume, will likely lead to a push toward weekly resistance and value area high levels. Until this occurs, traders should watch for further consolidation within the apex zone.

短期内,预计 BONK 将继续在顶点区域内波动。日内低点在月度支撑位附近形成走高可能预示着早期的强势。如果价格突破动态阻力位且成交量强劲,则可能开启一轮看涨反弹,直逼周线阻力位。反之,跌破支撑位将使当前结构失效,并可能导致价格目标下调。