以太坊价格周五暴跌超过 6%,延续了自 3 月 24 日达到 2,105 美元峰值以来的下跌趋势。

Ethereum (ETH) dropped to a low of $1,880, its lowest level since March 18. It has now erased most of the gains made in the past two weeks.

Ether crashed after the US released hot inflation data, pointing to higher interest rates for longer. The core Personal Consumption Expenditure Index rose from 2.7% in January to 2.8% in February. The headline PCE rose to 2.5%, higher than the Federal Reserve target of 2.0%.

These numbers mean that inflation will remain stickier for a while, especially after Donald Trump implements his Liberation Day tariffs. Higher inflation means the Federal Reserve may hold higher interest rates for longer.Â

This explains why other risky assets dropped after the PCE report. The S&P 500 index dropped by 1.50%, while the Nasdaq 100 and Dow Jones crashed by 2% and 1.2%, respectively. Most cryptocurrencies, including Bitcoin (BTC) and Cardano (ADA) also crashed.Â

在特朗普征收关税之前,恐惧与贪婪指数跌至 25,以太坊价格也暴跌。经济学家警告称,这些关税可能会导致经济衰退,抹去乔·拜登执政期间的部分增长。

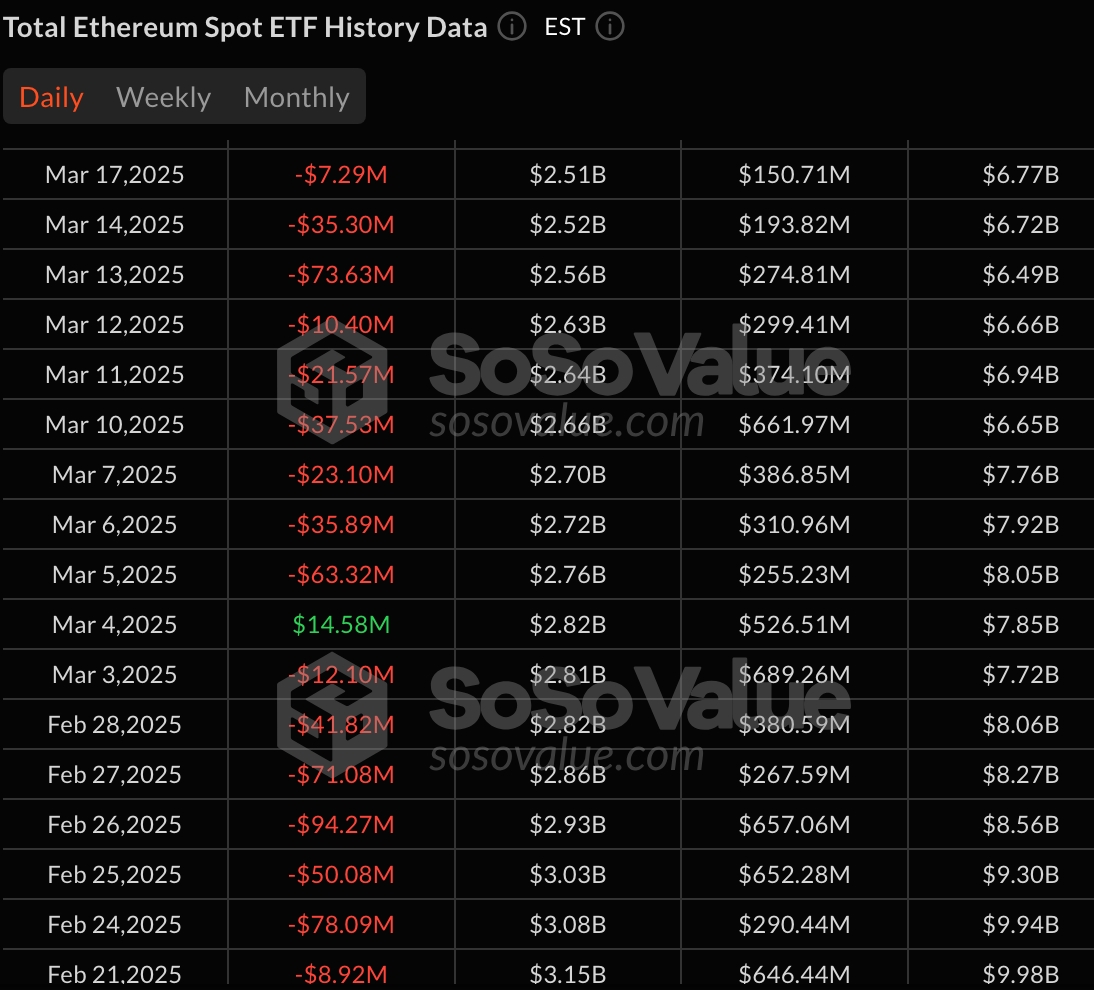

此外,由于以太坊的挑战依然存在,华尔街投资者保持观望态度。SoSoValue 数据显示,3 月份现货以太坊 ETF 仅有一次流入。3 月 4 日,它们的净资产增加了 1480 万美元,此后资产不断减少,累计资产仅为 24 亿美元。所有以太坊 ETF 的资产总额仅为 68.6 亿美元。

此外,以太坊在去中心化金融、非同质化代币和去中心化交易所等关键行业的市场份额持续下滑。其市场份额已被 Sonic 和 Berachain 等第 1 层链和 Base 和 Arbitrum 等第 2 层网络所蚕食。

ETH 价格也因技术原因暴跌。周线图显示,它在 4,000 美元处形成三重顶形态,颈线位于 2,130 美元,这是去年 8 月的最低水平。

以太坊本月初跌破该颈线,然后在本月重新测试。突破和重新测试模式是一种流行的延续信号。它还形成了看跌旗形模式,由一条垂直线和一些盘整组成。

因此,该货币有可能跌至 10 月 9 日的最低点 1,537 美元。突破 2,131 美元的阻力位将使看跌观点失效。