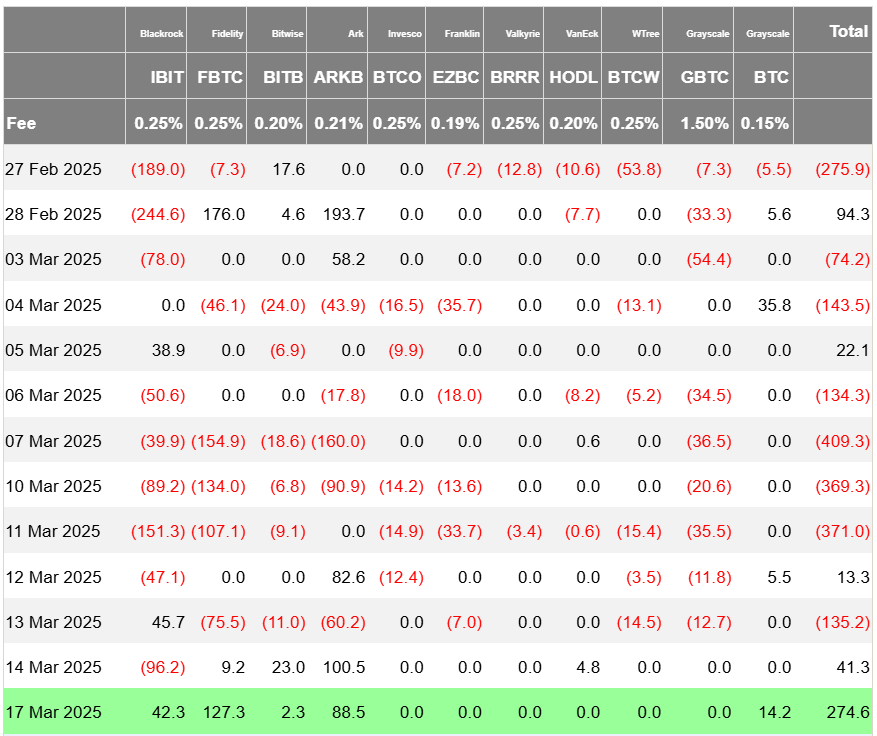

3 月 17 日,比特币交易所交易基金流入资金达 2.746 亿美元,引发人们对可能出现逆转的猜测。

比特币 (BTC) ETF 经历了显著的转变,在 3 月 17 日以 2.746 亿美元的巨额流入结束了连续的资金流出,创下了自 2 月 4 日以来的最高单日流入量。所有五只比特币基金均实现净流入,其中富达的 FBTC 以 1.273 亿美元领跑。ARKB 位居第二,录得 8850 万美元的新流入量,其次是贝莱德的 IBIT,为 4230 万美元,Grayscale 的比特币基金为 1420 万美元,Bitwise 的 BITB 为 230 万美元。当天没有一只基金录得净流出。

虽然这些数字看起来令人鼓舞,但值得注意的是,根据 SoSoValue 的数据,比特币 ETF 刚刚结束了连续五周近 54 亿美元的资金流出。This was largely driven by the macroeconomic uncertainty ensuing after Trump had introduced tariffs, which offset the positive impact of his efforts to buttress Bitcoin and other assets by including them in the strategic reserve.

Meanwhile, Bitcoin price is currently consolidating around the $83,000 level, currently trading for $82,883 — down by just over 1% for the day. The 20-day exponential moving average sits at $85,559, acting as a dynamic resistance level BTC is struggling to break above. The failure to reclaim the 20-day EMA suggests that bears remain in control. If the price manages to break and hold above the resistance at $85,500, a move toward $88,000 – $90,000 could be on the horizon. However, if it drops below the $82,000 support, further downside toward the next support level at $80,000 might be in store.

然而,如果我们缩小范围,整体趋势仍然表明长期看涨潜力,因此 3 月 17 日 2.746 亿美元的流入可能是在长期流出期后机构信心重现的信号。

据交易员 Coinvo 称,比特币价格最近突破了杯柄形态,并形成了看涨旗形形态,预示着未来几个月可能会上涨至 125,000 美元。因此,只要比特币能够收复关键阻力位,82,000 美元至 83,000 美元附近的看跌盘整可能成为下一次上涨的基础。

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.