Newmarket Capital 首席执行官 Andrew Hohns 建议将比特币纳入政府债券,以减少国家债务,并购买比特币作为美国战略储备。

在 3 月 11 日比特币 (BTC) 政策研究所举办的“美国比特币”会议上,霍恩斯提出了“比特币债券”的想法,这是一种将比特币纳入政府融资的新型美国国债。这个想法是通过发行债券来降低政府借贷成本并建立战略比特币储备,同时为美国家庭提供免税投资工具。

Hohn 建议美国政府发行约 2 万亿美元的比特币债券,其中 90% 用于政府采购,10% 用于购买比特币。这意味着每 100 美元中,约有 10 美元将用于购买 BTC。

“如果一开始就发行 2 万亿美元的比特币,那么按照每 BTC 90,000 美元的价格购买,就意味着价值 2000 亿美元的比特币。也就是 222 万比特币。当然,价格会波动,我们购买的数量可能会有所不同,”Hahn 在演讲中说道。

Newmarket Capital 首席执行官表示,这些债券将使美国联邦政府能够购买价值 2000 亿美元的比特币,同时为政府节省 5540 亿美元的 10 年期利率。

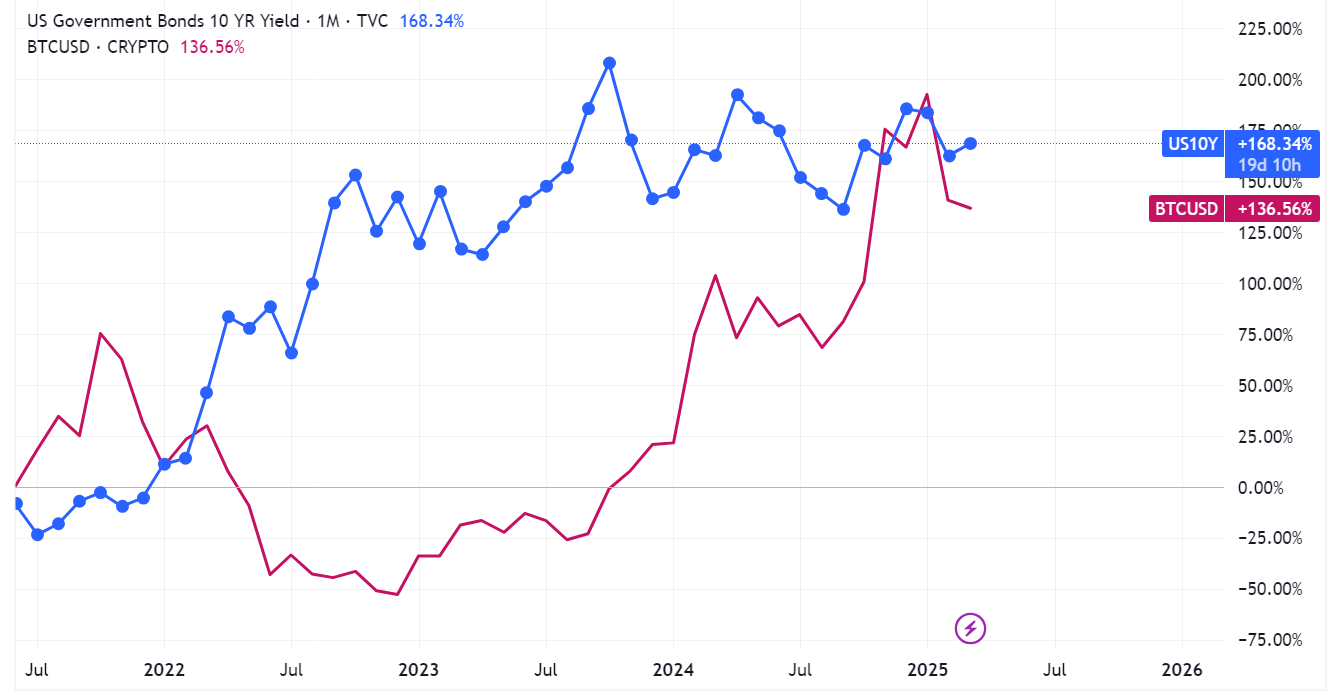

这是因为比特币债券的年利率仅为 1%,远低于美国国债 4.5% 的利率,因此可以大幅削减利息支出。

Moreover, he said Bit Bonds would become an attractive investment for foreign investors, because they can serve as eligible collateral for range of different swap and derivative arrangements. According to Hahn, investors stand a chance to receive a 4.5% compound annual growth rate on a senior basis, which aligns with the current Treasury yields.

After earning this fixed return, investors receive a 50% share from the upside of the Bitcoin purchase, while the U.S. government receives the remaining 50%. Depending on Bitcoin’s performance, the total returns for investors can be quite attractive, ranging from nearly 7% to as high as 17% annually on a tax-free basis.

“It produces a government entitlement of Bitcoin that is slightly greater than $50.8 trillion which is the expected size of the funded federal debt in the year 2045. In other words, with this plan, we’re in a position to defease the federal debt,†explained Hahn.

In addition, he also suggested Bit Bonds become available for American citizens as it is a †powerful tool to defend against inflation.†As a savings instrument, Hahn said the bonds should be free of income tax and capital gains tax for the American people.

他声称一个家庭可以投资 2,900 美元,在 10 年内获得 7% 到 17% 的收益,具体取决于比特币多年来的表现。