周四 Robinhood 宣布上市后,Arbitrum 的价格上涨了 12.9%,尽管 ARB 的价格自历史最高点以来仍下跌了 80% 以上。

以太坊的第 2 层解决方案 Arbitrum (ARB) 现已在 Robinhood 上交易,加入了比特币 (BTC)、以太坊 (ETH)、Solana (SOL) 以及其他山寨币的行列。这家总部位于美国的在线经纪平台在 3 月 5 日星期三的 X 帖子中表示,用户可以通过其专注于加密货币的部门 Robinhood Crypto 交易 ARB。

公告发布后,Arbitrum 的价格飙升 12.98% 至 0.4258 美元。然而,根据 crypto.news 价格数据,即使价格上涨,该代币仍比 2024 年 1 月达到的 2.26 美元峰值低 82%。

1 月底,crypto.news 表示,Arbitrum 代币可能即将迎来强劲的看涨突破,因为链上代币交易量突然跃升 118%,巩固了数月来的最佳一周表现。另一个积极的催化剂是,Arbitrum 形成了下降楔形形态,该形态由两条下降和汇合的趋势线组成。这两条线正接近汇合水平,预示着潜在的反弹,可能将 Arbitrum 价格推高至 1.2470 美元。

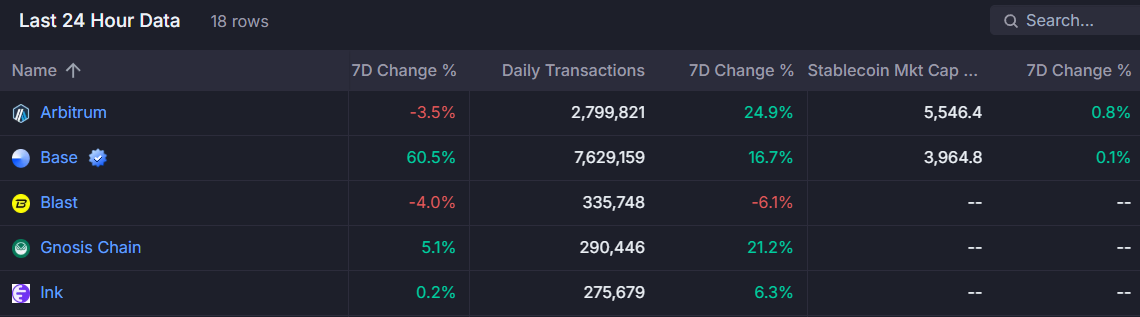

与此同时,Artemis 的链上数据显示,交易员们对最近的新闻反应积极,过去一周日交易量增长 25%,达到 280 万笔。最活跃的三个地址似乎与 Tether 和 Circle 的智能合约相关联,暗示稳定币转换量增加,这可能表明交易员愿意利用价格波动。

Arbitrum 由 Steven Goldfeder、Harry Kalodner 和 Joshua Goldfeder 于 2016 年创立,是一个第二层区块链,旨在帮助以太坊以更低的成本处理更多交易。它通过从主以太坊网络卸载一些处理和数据存储来解决以太坊的高费用和拥堵问题。

由于以太坊智能合约的执行需要节点处理每一步,因此交易成本会迅速增加。通过在链下处理部分工作,Arbitrum 旨在减少拥堵、降低费用并提高整体效率。