由于恐慌情绪在整个加密货币市场蔓延,恒星币价格连续第三天下跌。

恒星币(XLM)跌至 0.2740 美元,为 2 月 3 日以来的最低水平,目前比 11 月份的峰值低 57%。

它的崩盘与大多数加密货币同时发生,因为比特币(BTC)和以太坊(ETH)已经进入熊市。

在瑞波币(XRP)价格回落并形成风险头肩形态后,恒星币可能面临风险,正如我们周一所写。H&S 模式由一个头、两个肩和一个颈线组成。它是技术分析中最看跌的图表模式之一,这意味着 XRP 价格可能很快就会下跌。

由于恒星币和瑞波币在加密货币行业中扮演的角色以及共同的起源,它们在历史上一直高度相关。恒星币的创始人杰德·麦卡勒布 (Jed McCaleb) 是瑞波币的最初创造者之一。这两个网络都专注于支付,并且都有很高的几率获得美国证券交易委员会对其各自交易所交易基金的批准。因此,瑞波币价格的下跌可能会进一步削弱恒星币。

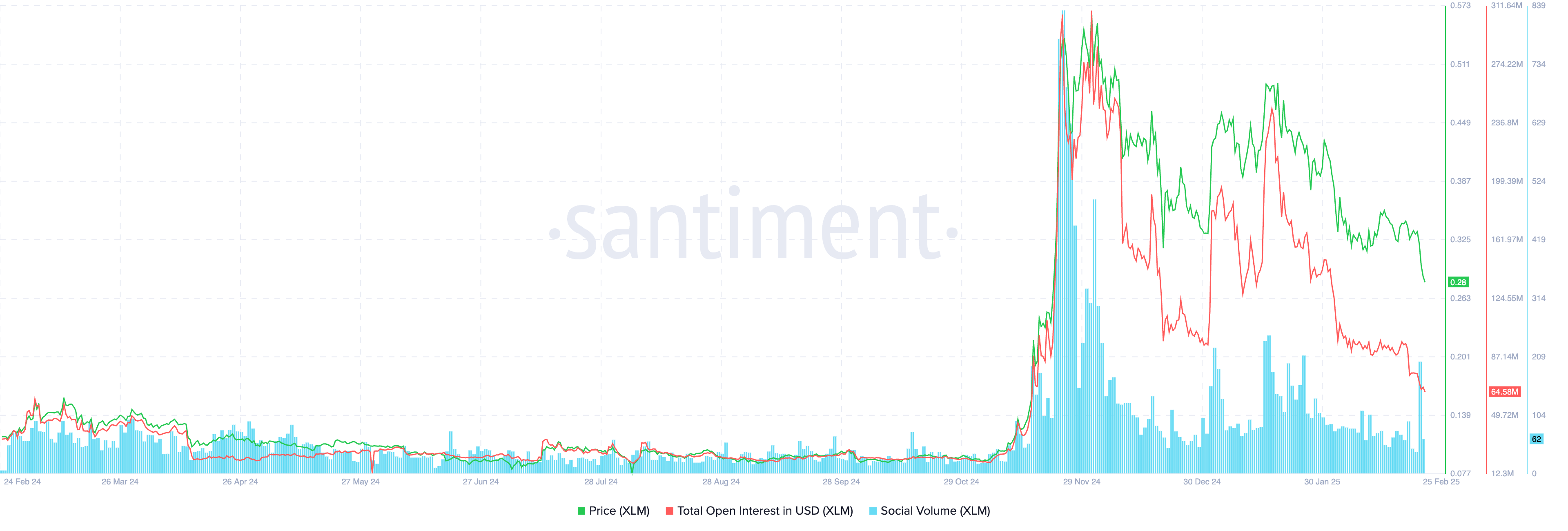

恒星币的基本面表明本周存在进一步下跌的风险。Santiment 的数据显示,恒星币的总未平仓合约已降至 6450 万,为 11 月以来的最低水平。

此外,社交量指标已从去年的高点 0.55 降至 0.28,表明社交媒体关注度下降。从历史上看,当社交媒体参与度高时,加密货币价格往往表现更好。

日线图显示,恒星币形成了一系列较低的低点和较低的高点。这些价格走势形成了下降通道模式,证实了下降趋势。

恒星币也正在接近死亡交叉,即 50 日和 200 日移动平均线相交时出现的交叉。此外,它已跌破 61.8% 斐波纳契回撤水平,这是大多数回调发生的关键技术区域。

考虑到这些因素,恒星币存在继续下跌的风险,下一个需要关注的参考水平是 0.2056 美元,即 78.6% 的回撤点,比当前水平低约 28%。