数字货币如何挖矿赚钱?区块链挖矿教程全解析

以太坊价格今年一直大幅下跌,成为表现最差的主要加密货币之一。

以太坊 (ETH) 已连续三周下跌,跌至 2023 年 3 月以来的最低水平。其价值已从 11 月的峰值下跌了一半以上,投资者损失了数十亿美元。本文使用关键图表分析了正在进行的以太坊价格暴跌。

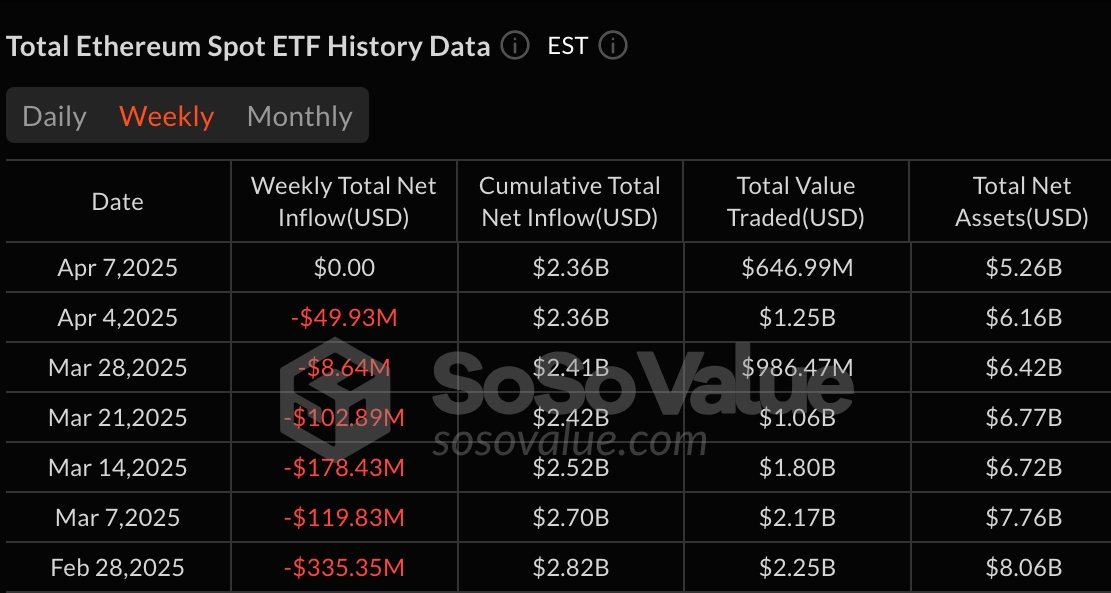

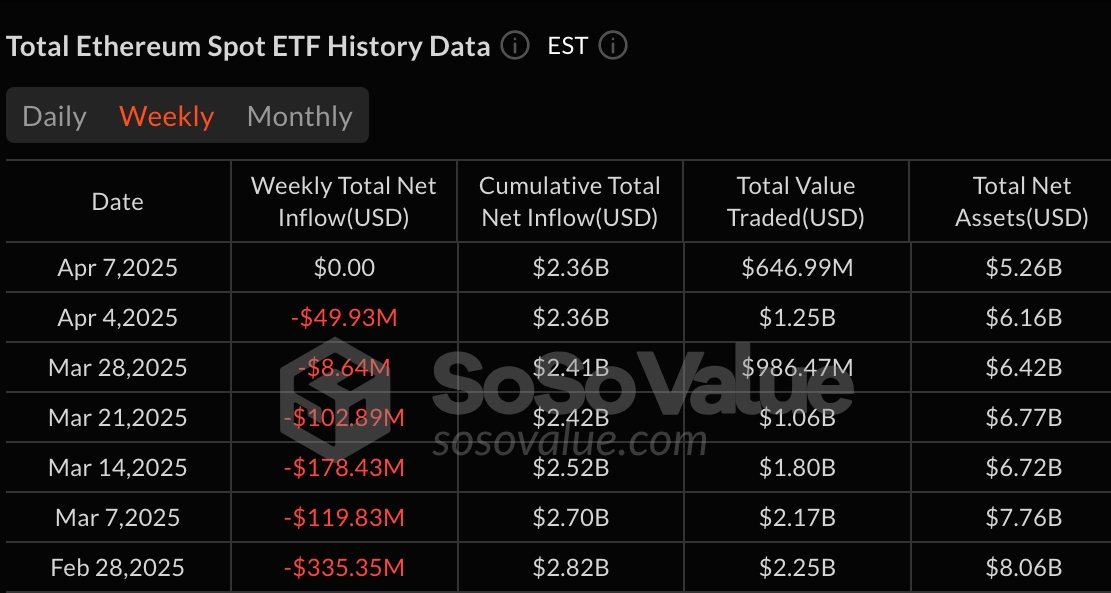

现货以太坊 ETF 出现大量资金流出

ETH 价格暴跌的原因之一是现货 ETF 今年出现大量资金流出,表明美国需求疲软。下图显示,这些基金在过去连续六周出现净流出。这些基金目前的净流入量仅为 23 亿美元,而比特币的净流入量为 350 亿美元。这表明投资者对比特币的偏好远远高于 ETH。

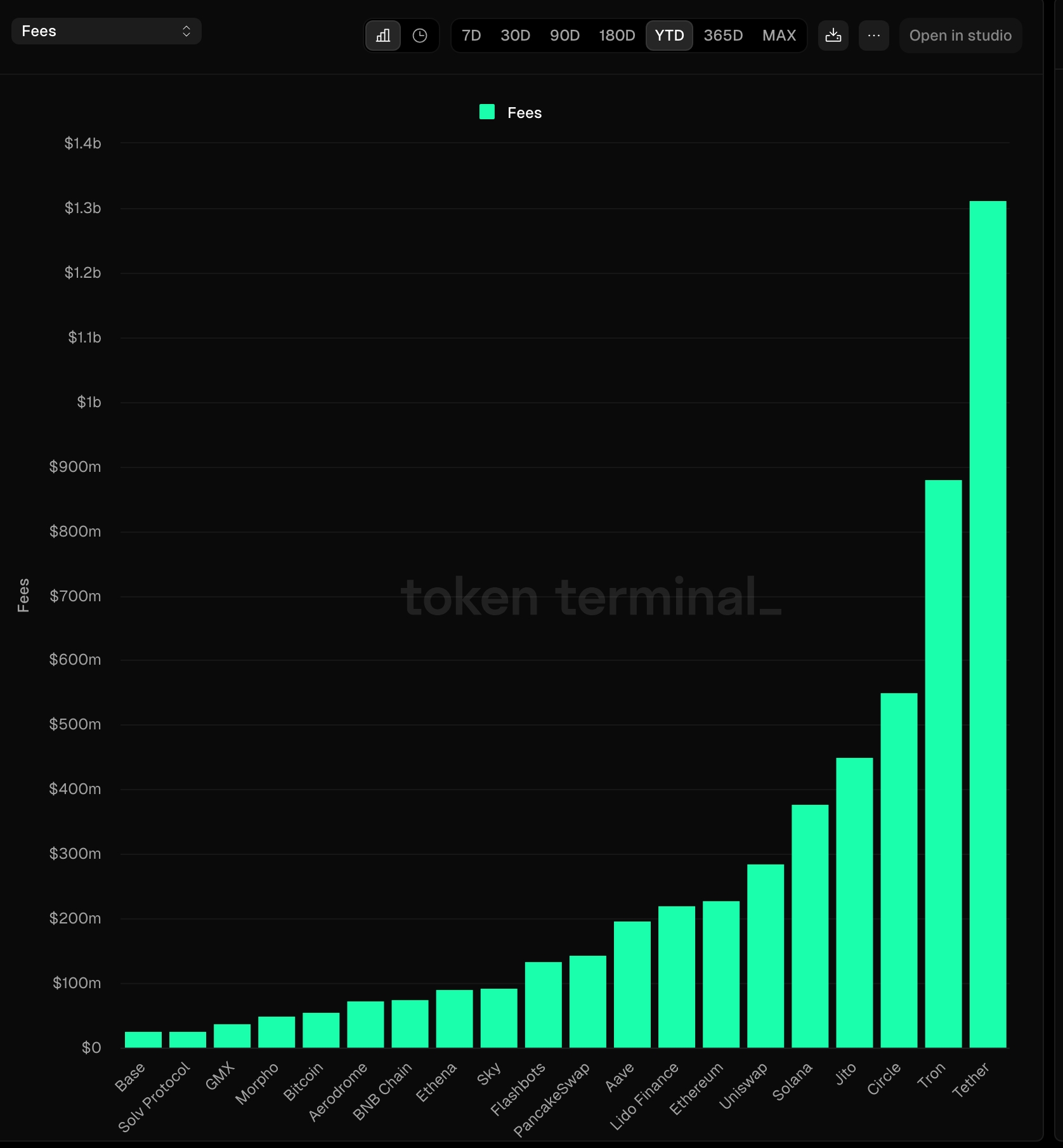

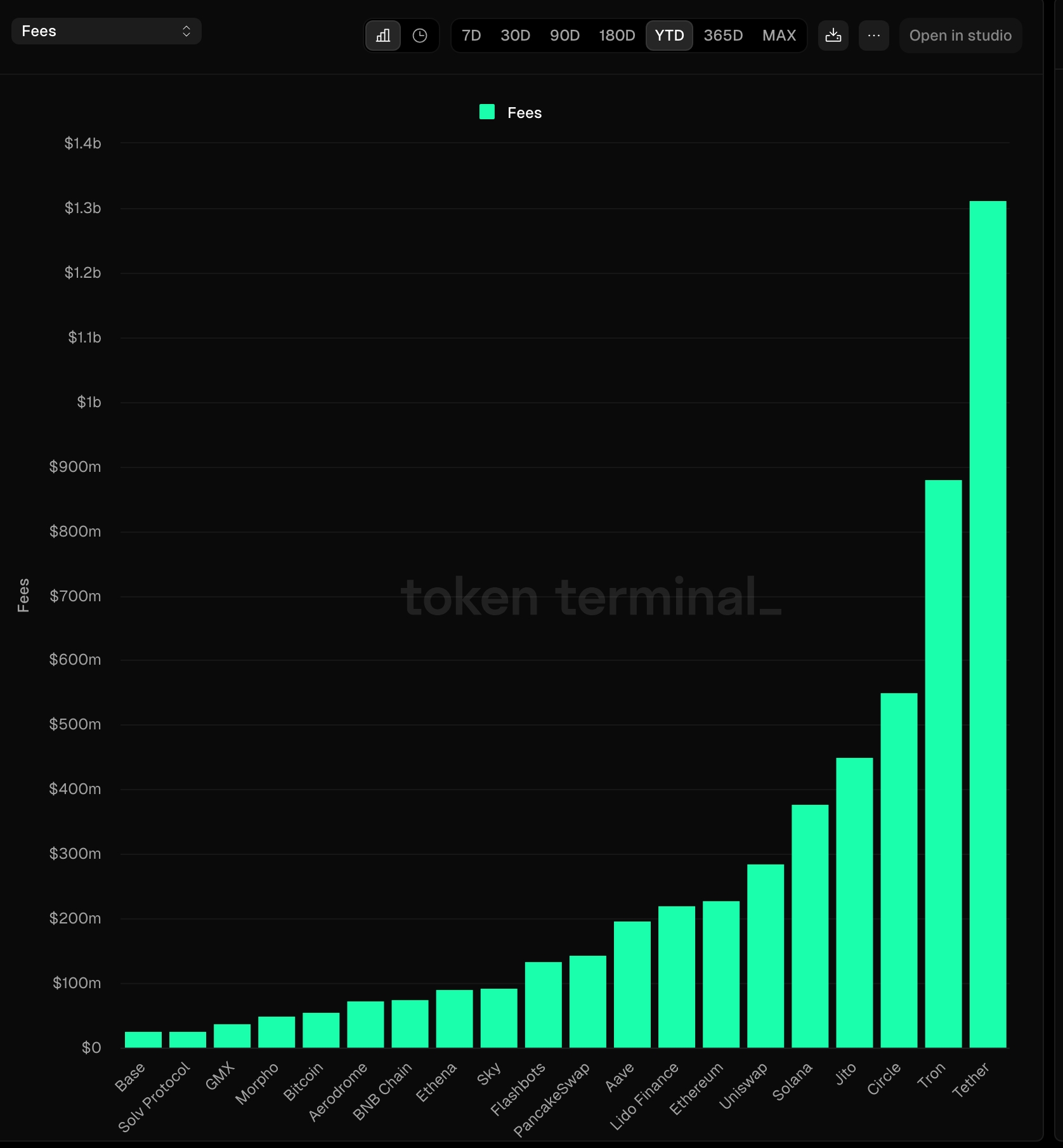

Ethereum no longer leads in fees

For a long time, Ethereum was the most profitable chains in the crypto industry as it dominated industries like DeFi,gaming, non-fungible tokens, stablecoins, and Real world Asset tokenization. This performance has changed this year, and the network has been overtaken by other popular chains.Â

下图显示,以太坊今年产生的费用为 2.27 亿美元。相比之下,Tether 的收入为 13 亿美元,Solana 为 3.76 亿美元,Tron 为 8.8 亿美元,这主要归功于它们与稳定币相关的活动。Jito 和 Uniswap 等平台的总费用也超过了以太坊。

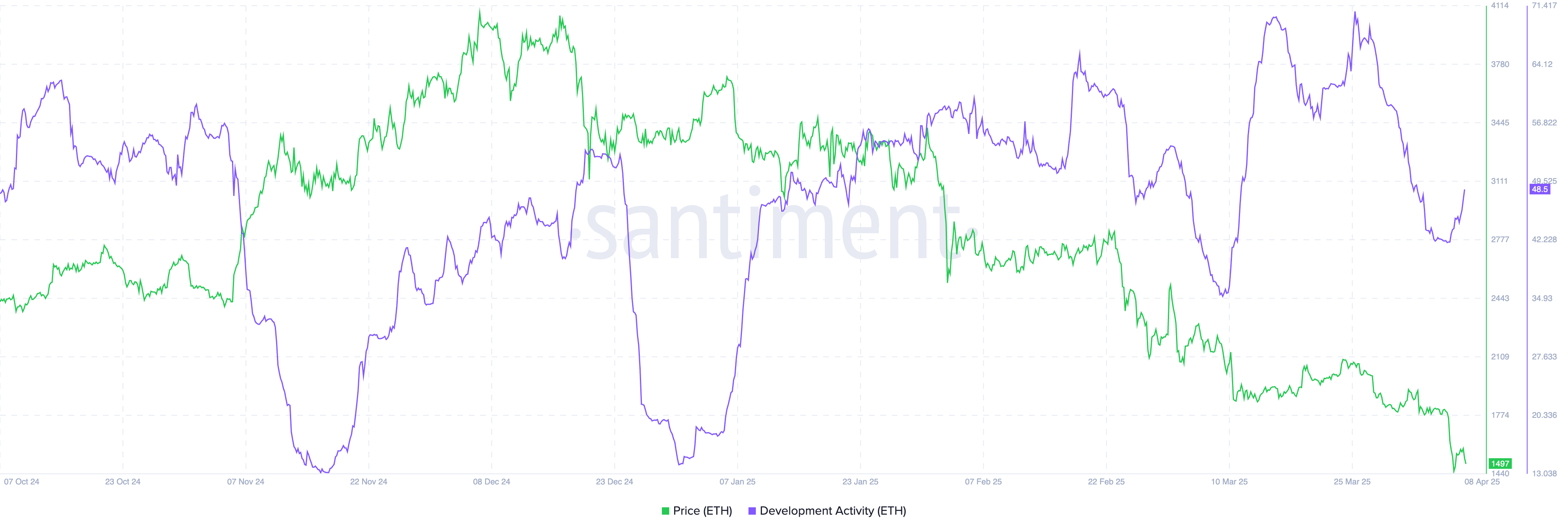

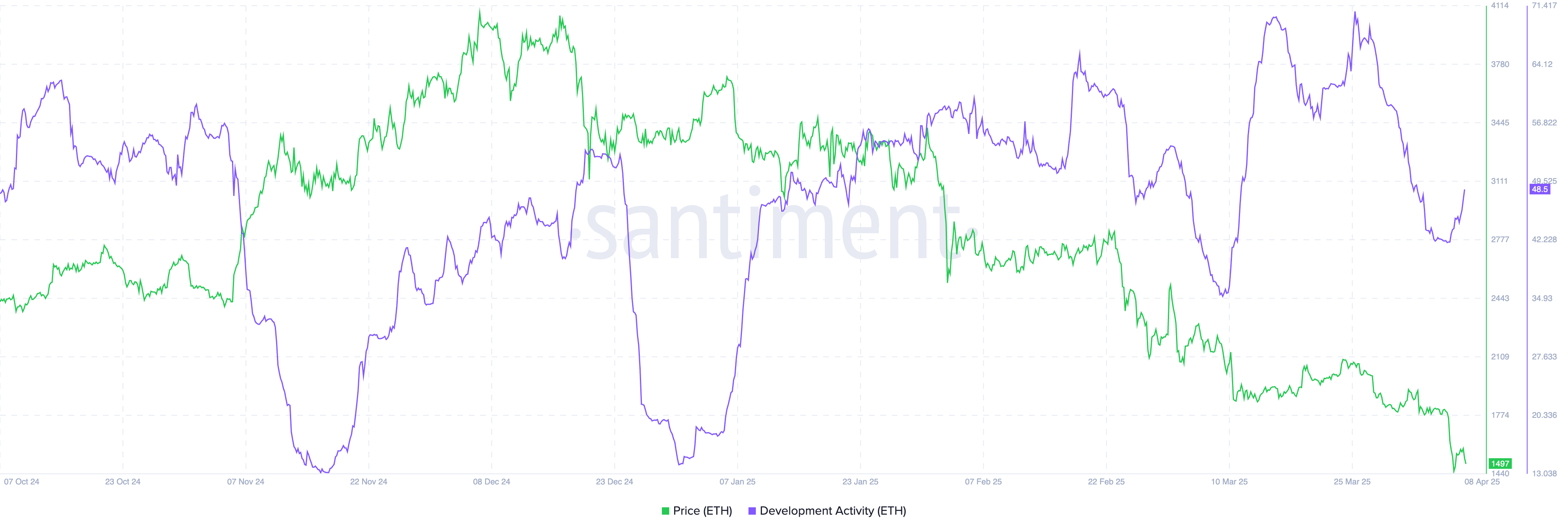

开发活动下降

On-chain data also indicates that Ethereum’s developer activity has declined in recent months. This drop is likely due to developers migrating to other fast-growing chains such as Solana, Sonic, and Berachain. Many have also shifted focus to Ethereum’s layer-2 solutions like Base, Arbitrum, and Optimism, which offer faster speeds and lower transaction costs.

Ethereum price formed a triple-top pattern

From a technical perspective, Ethereum has fallen sharply after forming a bearish triple-top pattern on the weekly chart. This formation consists of three peaks at around $4,062 and a neckline at $2,132 — a key support level last tested on August 5.

ETH has now broken below this neckline, confirming the bearish signal. It has also fallen beneath both the 50-week and 100-week moving averages. As a result, the next downside target could be $1,000.

Summary

以太坊在 2025 年经历了大幅下跌,11 月份 10,000 美元的投资变成了仅 3,650 美元。疲软的基本面和负面技术指标表明未来几个月可能会进一步下跌。

以太坊价格今年一直大幅下跌,成为表现最差的主要加密货币之一。

以太坊 (ETH) 已连续三周下跌,跌至 2023 年 3 月以来的最低水平。其价值已从 11 月的峰值下跌了一半以上,投资者损失了数十亿美元。本文使用关键图表分析了正在进行的以太坊价格暴跌。

现货以太坊 ETF 出现大量资金流出

ETH 价格暴跌的原因之一是现货 ETF 今年出现大量资金流出,表明美国需求疲软。下图显示,这些基金在过去连续六周出现净流出。这些基金目前的净流入量仅为 23 亿美元,而比特币的净流入量为 350 亿美元。这表明投资者对比特币的偏好远远高于 ETH。

Ethereum no longer leads in fees

For a long time, Ethereum was the most profitable chains in the crypto industry as it dominated industries like DeFi,gaming, non-fungible tokens, stablecoins, and Real world Asset tokenization. This performance has changed this year, and the network has been overtaken by other popular chains.Â

下图显示,以太坊今年产生的费用为 2.27 亿美元。相比之下,Tether 的收入为 13 亿美元,Solana 为 3.76 亿美元,Tron 为 8.8 亿美元,这主要归功于它们与稳定币相关的活动。Jito 和 Uniswap 等平台的总费用也超过了以太坊。

开发活动下降

On-chain data also indicates that Ethereum’s developer activity has declined in recent months. This drop is likely due to developers migrating to other fast-growing chains such as Solana, Sonic, and Berachain. Many have also shifted focus to Ethereum’s layer-2 solutions like Base, Arbitrum, and Optimism, which offer faster speeds and lower transaction costs.

Ethereum price formed a triple-top pattern

From a technical perspective, Ethereum has fallen sharply after forming a bearish triple-top pattern on the weekly chart. This formation consists of three peaks at around $4,062 and a neckline at $2,132 — a key support level last tested on August 5.

ETH has now broken below this neckline, confirming the bearish signal. It has also fallen beneath both the 50-week and 100-week moving averages. As a result, the next downside target could be $1,000.

Summary

以太坊在 2025 年经历了大幅下跌,11 月份 10,000 美元的投资变成了仅 3,650 美元。疲软的基本面和负面技术指标表明未来几个月可能会进一步下跌。

版权声明:本文由比特之家用户上传发布,不代表比特之家立场,转载联系作者并注明出处: https://m.bitcoin688.com/news/66018.html